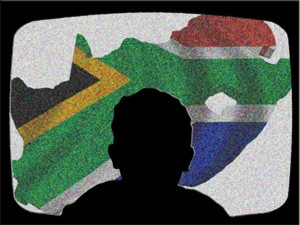

The outlook for SA's television landscape is a far cry from that of many global counterparts, which Ericsson predicts will have practically said goodbye to analogue by the year 2020.

Ericsson, the company behind the "Networked Society" campaign, mapped out the future of TV in its Media Vision 2020 at this year's NAB Show, a global B2B media and entertainment event, currently under way in Las Vegas.

According to the Sweden-based firm, the 2020 landscape will look like this: nine billion people, over eight billion mobile broadband subscriptions, 1.5 billion homes with digital television - and analogue all but history.

"The vision of the Networked Society will be realised as more than 50 billion connected devices, of which 15 billion will be video-enabled, will rely on mobile IP (Internet Protocol) networks dominated by video."

Ericsson says this picture of a new era of entertainment and connectivity represents what it expects will be a $750 billion industry in six years' time.

But SA is unlikely to have any significant part of the near trillion-dollar pie, say industry observers.

Evolution exclusion

World Wide Worx MD Arthur Goldstuck says SA is far behind the world, in many respects, when it comes to TV and video services and consumption.

While home-grown pay-TV service, Naspers-owned MultiChoice, introduced a world first service many years ago, says Goldstuck, it has not evolved to the plug-and-play status that the future of TV is characterised by.

"In future, TV will be plug-and-play, because smart TVs will configure themselves. Although we are starting to see that with IPTV and smart TVs, we are still a long way from that being possible for the ordinary person in SA. The techies and early adopters on the cutting-edge of technology might be able to say it is possible; the average [South African] is left out of this evolution."

Having said that, Goldstuck notes there have been some dramatic advances in TV in SA. "The services MultiChoice offers in particular make it possible for SA to experience a slice of the future of TV, but when it comes to IPTV we are still in darkness."

He says while content via over-the-top (OTT) is not a mass market prospect by 2020, YouTube video consumption will be big.

"YouTube, Vimeo and similar services will dominate mobile broadband in 2020, but that is not to say broadcast TV will. There is a big difference between video (content available for download) and TV (live or broadcast content) over Internet." The latter, says Goldstuck, is probably a decade away from being a reality in SA.

Tech analyst Liron Segev, from TheTechieGuy.com, says SA is continuing the trend of being connected to the Net by both fixed-lines and mobile. "The networks have invested in LTE, so the theoretical speeds are available. It all boils down to the government and leading the way with spectrum.

"Networks are also trying to discontinue 2G devices and focus on 3G and [other mobile technologies]. We are seeing the trends of [increased] video consumption in the form of YouTube so we are heading in that direction."

Goldstuck says there is a tendency in the tech world to get carried away by future outlooks. "It often boils down to the haves having more. In 2020, the networks will be able to offer OTT TV options, which will serve the market DStv serves today. It's a service for the haves - not the have-nots."

Africa Analysis analyst Dobek Pater says, by 2020, large parts of SA's population will still be consuming TV more or less as they are consuming it now.

"This is a function of disposable income levels and education/level of ICT competency."

Digital difference

Goldstuck says what will change the TV landscape in SA, is digital TV - not mobile broadband.

"The real challenge by 2020 is to get all South Africans connected to a decent broadband service to allow for standard Internet consumption.

"For SA, mobile broadband [at that stage] still won't be at the price and quality level that will make mass consumption of HD TV possible. Bear in mind, the early adopters and techies are getting there - but in terms of the mass market, it is non-existent."

Every country in the world is moving terrestrial television to digital in a bid to meet the International Telecommunication Union's mid-2015 deadline for when protection of analogue signal will cease. The move will also free up much-needed spectrum - the so-called digital dividend - which can be used to offer broadband services.

Adam Thomas, media research manager at Informa, notes the 2015 deadline for many countries to switch from analogue terrestrial TV to digital terrestrial TV (DTT) is fast approaching. "However, I anticipate that many countries, particularly those in emerging markets, will miss this deadline by some distance."

Pater says while all of the developed world will likely be rid of analogue and on digital by 2020, the developing world - including SA - will be in the process of migrating from analogue to digital.

"Digital signal distribution will become mandatory from 2015 onwards [and] I expect all countries will probably have completed the digital switch-over by 2017. However, many households will still be using analogue TV sets and it will take several years for them to migrate to digital TV sets."

Thomas says he does not anticipate any radical changes to consumption patterns in SA over the next six years.

"If you think back six years to 2008, I recall that the message at that time was that digital terrestrial was about to be launched, with switch-off targeted for 2011 - and we all know how that worked out.

"Bearing that in mind, it's difficult to imagine that over the next six years there will be anything but gradual progress towards new types of viewing, rather than anything more revolutionary."

He says Informa's own forecasts anticipate that mobile Internet will make good progress over the next few years, but networks will not be robust enough to deliver a bandwidth-intensive high-quality video experience to a mass audience.

"On top of that, the high cost to consumers of receiving such content via mobile Internet systems will also limit the target audience."

As is so often the case, notes Thomas, MultiChoice seems well positioned to exploit opportunities that do arise in this space, considering the company has made progress in extending its service to include online video on-demand (VOD) delivery.

African perspective

Johan Meuwissen, head of operations support system/business support system for Ericsson in sub-Saharan Africa, says digital television uptake in the region will be driven by mobile devices.

Meuwissen notes Africa has historically suffered from a lack of infrastructure to enable VOD, as fixed-line broadband is not very available, and TV choices are limited to satellite and analogue.

The trend in developed countries, such as those in Europe and the US, is to move to VOD and to consume content while on the move, says Meuwissen.

South African media company Naspers, which has a monopoly on pay-TV in SA, provides satellite services to 7.3 million homes in 48 countries in Africa. It is also rolling out DTT outside of SA, under the GOtv brand, and has 547 000 homes signed up in eight countries.

Meuwissen notes, however, that only 27% of homes in sub-Saharan Africa have televisions, and there are barriers to access, such as a lack of electricity and affordability. The level of penetration in SA is higher, he adds.

Consumers on the continent are looking for alternatives, says Meuwissen. He points out mobile penetration is at 70% and data-ready networks are taking off "big time". He notes LTE is being introduced and smartphone costs are coming down.

As a result, says Meuwissen, mobile television is a viable alternative for sub-Saharan Africa and the digital television revolution will be driven by this platform in the region. He adds more OTT players are coming to market, and operators are looking at how to monetise this sector.

Share