Telkom has managed to cut back on expenses, contributing to healthier operating margins, but has yet to see significant top line growth and stem the trend of declining fixed-line voice revenue.

In the first half of the year, the operator recorded all but flat revenue, which only gained 1.6% to R13.3 billion. Its bottom line came in at R1.2 billion, down from last year's R3 billion, although the six months to September 2013 benefitted from R2.17 billion in once-off cost savings.

Telkom's profit was also affected this year by the R325 million it paid out in early severance and voluntary retirement packages to let 406 staff members go. On a normalised basis, profit gained from R791 million to R1.4 billion.

However, Telkom's operations have yet to show significant growth, as operating profit declined from R3 billion to R1.6 billion. The telco also continued to shed fixed lines, which have dropped from 3.7 million to 3.5 million, and voice operating revenue declined 4.1% to R7.8 billion.

Concerns

Ovum analyst Richard Hurst says Telkom does have some "good stories" such as growth in its mobile unit and ADSL lines, but its operating profit is "a bit of a concern". He questions whether the company's turnaround strategy is going well enough.

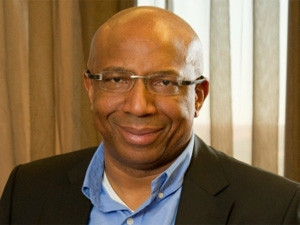

CEO Sipho Maseko, however, says the interim results show "the business is on track for future growth", and its multi-year turnaround strategy, which began in 2013, "is paying off".

"We expect this positive momentum will continue for the remainder of the financial year."

However, Maseko concedes Telkom has found the operating environment "challenging" and the telecoms sector is still competitive, putting margins under pressure, especially in the enterprise segment.

BMI-TechKnowledge director Brian Neilson notes Telkom, which seeks to create digital businesses and homes, faces several challenges, including increased competition in the fibre space, and fixed-to-mobile substitution, which it is "almost fuelling" by not pushing new copper lines.

Telkom says it is still committed to growing revenue and operating profit, but is "cautious of the negative economic headwinds". Depending on how it performs, its debt and cash levels and growth opportunities, it intends reinstating the dividend at the end of the year, it adds.

Bright spots

Telkom did report some good news, such as ADSL subscribers gaining 7.4% to hit almost a million, and Telkom Mobile boosting its subscriber base 26.7% to just over two million users. Its mobile unit also grew revenue 55% to R1.4 billion and improved its earnings before interest, tax, depreciation and amortisation.

Neilson notes, however, that its gains have not shored up the decline in its fixed subscriber base, and adds Telkom has realised its operating revenue is sliding and that organic growth will be hard to find. This is why Telkom is seeking to buy Business Connexion - a R2.67 billion deal that is still awaiting regulatory approval, he says. Hurst says this acquisition, and its pending deal with MTN to share radio network assets (also awaiting regulatory approval), show promise for the company.

Telkom has continued to focus on costs, and operating spend declined 2.4% to R9.2 billion as it trimmed staff, marketing and security costs. The company is in the midst of a retrenchment process that aims to cull as many as 2 500 management positions during a three-phase process.

Share