Those who follow developments within West Africa's oil-rich and most populous nation Nigeria will know that the country has been through significant socio-political and economic change of late. This year, the country opened a new chapter in its development after former military leader Muhammadu Buhari, under the All Progressive Congress (APC) Party, emerged as the new president. He beat rival Goodluck Jonathan in the polls at the country's general elections held in March.

Buhari has his work cut out for him. Issues like corruption, government inefficiency, lower oil prices, as well as the continued insurgency of Islamic militant organisation Boko Haram represent the toughest challenges.

However, as political reporters have pointed out, the win for Buhari is the first time an opposition party has replaced a ruling party via a democratic election in Nigeria.

The implications of this landmark APC victory have already filtered through into critical markets like ICT and telecommunications, and captured the interest of investors.

There is a sense of anticipation and expectation in the country. Just a few months after the newly elected president was sworn in, there is already speculation over what kind of strategy the Buhari-led government is likely to apply to develop these sectors.

Issues like the national broadband policy and more widespread broadband access, spectrum allocation towards the further implementation of digital migration strategy, the role of the industry watchdog, the Nigeria Communications Commission (NCC), and service delivery by operators still require consistent governance and effective administration.

Leading the way

It could be argued that the first signs of intention from the powers-that-be have already been seen in the change of leadership at the NCC, which took place in July.

In May, regional media reported that former president Goodluck Jonathan was alleged to have secretly awarded frequency spectrum up for public auction by the NCC. The reports stated that the licences for the spectrum, valued at approximately US$1 billion, were awarded to Globacom and Visafone. News outlets reported that the licensing did not take place under the conventional bidding process and this prevented the regulator from advertising and supervising an auction.

Predictable policies

The sentiments expressed by some technology users and business people seems to suggest that many would like the input of more technocrats to the existing regime, as this will address the need for consistency in what works.

Telcos have also weighed in, requesting that the new administration foster what is described as a 'better regulatory environment' as well as predictable policies.

In March, the country's minister of communication technology, Omobola Johnson, announced that the country needed

US$3.7 billion to make broadband internet access available across the country, specifically to under-served regions.

The NCC is seen as playing a pivotal role in pursuing an aggressive broadband development plan, as laid out by the National Broadband Plan 2013 - 2018.

This year, the target is believed to be at least 50 percent of the population reached with 3G. At the same time, the Broadband Plan is to increase the broadband penetration rate from the current level of six percent to 30 percent by 2018.

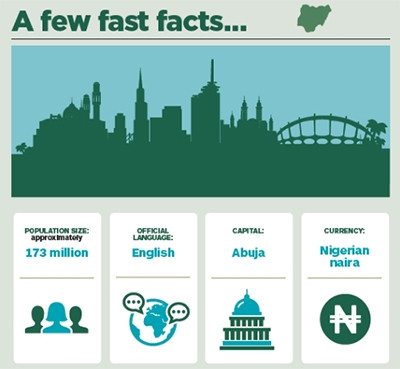

Authorities have not shied away from the opportunity to 'sell' Nigeria to prospective investors. At the ITU Telecom World 2014 in Doha, Johnson summarised the country's strengths as being the size of its population, active telephone line connectivity of over 134 million and a teledensity of 96 percent.

However, market analysts have mentioned the impact that lower oil prices may have on the economy, the ever-present threat of Boko Haram and power shortages, as well as pressure on resources as a result of growth of the population as holding investors back.

As Deloitte's Competitiveness: Catching the next wave Africa report states: "...wealth generated by energy production has yet to lead to great advances in social progress. On scales related to meeting basic needs, education and basic liberties, Nigeria still trails many of its African peers."

The report also points out that Nigeria's index of inequality, or Gini coefficient, stands at 0.43 and addressing these challenges will involve financial inclusivity, improvement in the collection of non-oil revenue and phased removal of fuel subsidies.

This article was first published in Brainstorm magazine. Click here to read the complete article at the Brainstorm website.

Share