The latest ruling re the ongoing feud between Apple and Samsung was the main story of the international ICT market last week, while at home, MTN's settlement re its Nigerian fine dominated the local news.

Key local news

* Mixed year-end figures from Telkom SA, with revenue up 13.9% but profit down 25.4%.

* The formal de-listing from the JSE (as of 20 June) of African Cellular Towers, Faritec Holdings and Square One Solutions Group.

* The acquisition by Informal Solution Providers, a telco product distributor, of micro-jobbing platform, M4JAM (Money for Jam). Following the acquisition, Informal Solution Providers will trade under the name M4JAM.

* MTN announced the Nigerian fine issue has been resolved with the Nigerian Federal Government and it will pay $1.671 billion spread over the next three years.

* The Centre for High Performance Computing of the CSIR has unveiled the fastest computer on the continent, a petaflops machine.

* SA has become the first country in Africa to host a Deloitte Cyber Intelligence Centre, which opened in Johannesburg.

* Telkom will merge its enterprise-focused Telkom Business unit into IT group Business Connexion.

* Netsurit CEO and co-founder Orrin Klopper is heading to New York as his company eyes expansion prospects in the US market.

* A renewed JSE cautionary by Huge Group.

* Withdrawn JSE cautionaries by MTN, MTN Zakhele and TCS.

* The appointments of Hannes Burger as MD of Fujitsu SA and Jason Goodall as CEO of Dimension Data.

* The departure of Brett Dawson, CEO of Dimension Data.

Key African news

* Nigeria's minister of communications said the ICT sector will contribute about 30% to its GDP by 2020.

* Vodafone officially entered the Zambian market to provide data and fixed Internet services through a partnership agreement with Afrimax.

Key international news

Netsurit CEO and co-founder Orrin Klopper is heading to New York as his company eyes expansion prospects in the US market.

* Aspen Technology bought Fidelis Group, a provider of asset reliability software that process industry companies use to predict and optimise asset performance.

* Fortinet purchased AccelOps, a provider of network security monitoring and analytics solutions.

* The acquisition by Help/Systems, a software utilities provider, of Linoma Software, a provider of secure managed file transfer and data encryption products.

* The acquisition by Crozier Fine Arts, an Iron Mountain Incorporated company, of art storage and handling company Fairfield Fine Arts through an asset purchase agreement.

* Nokia bought Gainspeed, a US-based start-up specialising in distributed access architecture solutions for the cable industry via its Virtual Converged Cable Access Platform product line.

* The over $32.5 million purchase by Rambus of the assets of Semtech's Snowbush IP.

* The $2.4 billion acquisition by Sky Network Television (New Zealand) of Vodafone's New Zealand unit, paving the way for a pivot by the British telecoms giant to faster growth markets in Asia.

* The EUR230 million (16%) investment by Singapore's sovereign wealth fund GIC in Eir (formerly Eircom Ireland).

* The $35 million (20%) investment by Chinese e-commerce firm Alibaba Group Holding's affiliate Ant Financial in financial data provider Shanghai Suntime Information Technology.

* A jury in the US District Court for the District of Hawaii has rendered a complete defence verdict in 3D Systems' favour in a lawsuit related to the company's acquisition of certain Web site domains in 2011. The jury also found in 3D Systems' favour on its counterclaim.

* The US Department of Justice asked the Supreme Court to overturn an appeals court ruling that had favoured Apple over Samsung Electronics in smartphone patent litigation, and asked that it return the case to the trial court for more litigation.

* IronSource, a maker of tools to help mobile app developers distribute and profit from their apps, and one of Israel's most valuable private tech firms, is waiting for more favourable conditions before considering a stock market listing.

* SoftBank Group is set to sell most of its stake in GungHo Online Entertainment in a deal valued at about $685 million.

* Yahoo received multiple bids at or above $5 billion for its core business.

* Very poor quarterly figures from Verifone Systems.

* Quarterly losses from Comtech Telecommunications, ModusLink, Renren, SeaChange International, Verint Systems and Volt Information Sciences.

* The resignation of Ron Gula, co-founder and CEO of Tenable Network Security (stays on as chairman).

* The death of Thomas Perkins, one of the founding fathers of modern venture capital investing and heavily involved in the tech sector and specifically with HP and its activities in the 2000s, including the removal of two of its CEOs.

* An IPO filing on the NYSE from Blue Coat, a provider of Web security solutions for global enterprises and governments and a company privatised six years ago.

Research results and predictions

EMEA/Africa:

* According to the latest Cisco Visual Networking Index, an annual look at the progress of IP traffic round the world, IP traffic will triple by 2020 and 82% of it will be video by 2020. Traffic is growing fastest in the Middle East and Africa, where the annual growth rate is 41%, followed by Asia Pacific, where the annual growth is 22%.

* IDC says workstation shipments in the EMEA region contracted by 1.5% year-on-year in 2015 and forecasts a flat 2016, with year-on-year growth of 0.9%, on the back of a moderate recovery in the economy, but with a highly uncertain outlook and increasing risks.

Worldwide:

* According to Gartner, global smartphone sales will continue to slow and will no longer grow in double digits. Worldwide smartphone sales are expected to grow 7% in 2016 to reach 1.5 billion units. This is down from 14.4% growth in 2015. In 2020, smartphone sales are on pace to total 1.9 billion units.

* Worldwide x86 and ARM server-class microprocessor revenue will increase 1.3% to $13.9 billion, while server microprocessor market unit shipments will increase 3.5% to 22.9 million units in 2016, predicts IDC.

* According to IDC, worldwide PC shipments are forecast to decline by 7.3% year-over-year in 2016, with progressively smaller declines through 2017 followed by stable volumes in 2018. However, growth in 2016 is now expected to be roughly 2% below earlier projections as conditions have been weaker than expected. Growth in 1Q16 came in at -12.5%, just below IDC's forecast of -11.3%, and inhibitors such as weak currencies, depressed commodity prices, political uncertainty, and delayed projects continue to constrain shipments.

* The total security appliance market showed positive growth in both vendor revenue and unit shipments for 1Q16, says IDC, marking the eleventh consecutive quarter of year-over-year growth. Worldwide vendor revenue in the first quarter increased 5.5% year-over-year to $2.47 billion, while shipments grew 9% year-over-year to a total of 580 007 units.

Stock market changes

* JSE All share index: Down 2%

* Nasdaq: Down 1%

* NYSE (Dow): Up 0.3%

* S&P 500: Down 0.1%

* FTSE100: Down 1.5%

* DAX: Down 2.7%

* Nikkei225: Down 0.2%

* Hang Seng: Up 0.5%

* Shanghai: Down 0.4%

Look out for

International:

* Verizon Communications submitting a second-round bid of around $3 billion for Yahoo's core Internet business.

* Vivendi SA buying out the founding family of French mobile-gaming company Gameloft SE, taking the French media and entertainment group a step closer to rebuilding its video game franchise.

* The buyer for the 3 000 patents that Yahoo is selling.

South Africa:

* The sell-off by Naspers of Allegro, its Polish online auction site.

Final word

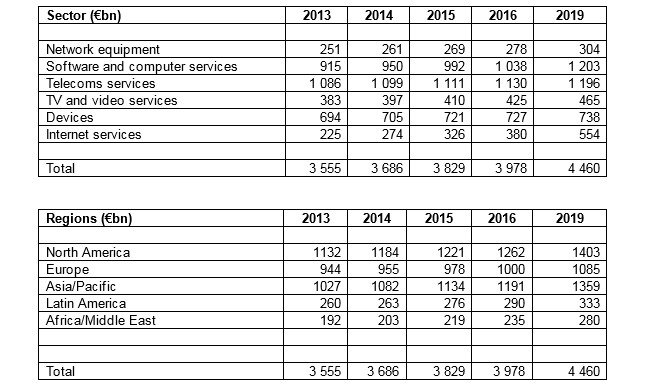

IDATE, a French NGO that tracks the global telecommunications, Internet and media markets, has published its 2016 DigiWorld Yearbook. Unlike the other industry research organisations, IDATE includes TV and video services and Internet services separately in its figures.

Other observations include:

* Device sales are sustained by smartphones as both computer and TV sales are floundering.

* Services and content represent close to half of the ICT revenue, with telecom services still earning the lion's share.

* The MEA region was 5.7% of the worldwide total in 2015 and rises to 6.2% in 2019.

* The largest growth rates are coming from the emerging markets.

* Europe is the slowest growing region.

Share