A handful of smallish acquisitions and several successful but small IPOs were the main stories of the international ICT market last week.

At home, the Vodacom/PRASA deal was the highlight of a very quiet week.

Key local news of the past week

* Satisfactory year-end figures from Silverbridge Holdings, with revenue up 6.8% and profit up 21.7%.

* Vodacom has entered into a 15-year strategic telecommunications partnership agreement with the Passenger Rail Agency of South Africa (PRASA), through its subsidiary Intersite Asset Investments, in a deal estimated to be worth over R1 billion.

* Renewed JSE cautionaries by the Huge Group and M-FiTEC International.

Key international news

Vodacom has entered into a 15-year strategic telecommunications partnership agreement with the Passenger Rail Agency of South Africa.

* Accenture acquired Kurt Salmon, a subsidiary of Management Consulting Group, in a move designed to expand the former's strategies capability in the retail sector.

* The Anders management team and employees bought CDI's UK-based subsidiary, CDI AndersElite, which provides staffing and recruitment services to firms in the UK built environment and rail industries.

* CA Technologies purchased BlazeMeter, a provider of next-generation, cloud-based performance testing solutions.

* Comcast acquired the 24% stake held by Ed Snider in Comcast Spectacor, thus raising its stake to 100%.

* Digicell bought Curacao's Tres Networks, the Caribbean island's fixed and international operator.

* Inovalon purchased Creehan Holding, the parent company of Creehan & Creehan, the industry's leading independent provider of specialty pharmacy and specialty medications management SaaS platforms.

* TCL Industries Holdings acquired Novatel Wireless' mobile broadband business for $50 million.

* Tech Data bought Avnet's technology solutions business for $2.8 billion.

* Thomson Reuters purchased trading technology firm REDI Holdings.

* Tessera Technologies acquired DTS, a premier audio solutions provider to home, mobile and automotive markets.

* Twilio bought Spain-based Kurento, the developer of software that promises to allow customers to reach billions of consumers with new video messaging features such as augmented reality, without the hassle of downloading plug-ins. The Kurento team, which was backed by European Commission funding, is behind the Kurento Open Source Project, which has become popular among multimedia developers.

* Vista Equity Partners purchased Infoblox, a network control firm, for $1.6 billion.

* Canon made a $40 million (19.9%) investment in T2 Biosystems, a company developing innovative diagnostic products to improve patient health.

* Softbank led a $750 million investment Grab, a Southeast Asian ride-hailing company.

* The shares of MGT Capital Investments, led by anti-virus software pioneer John McAfee, dropped significantly following the New York Stock Exchange denying approval of the listing of shares for a planned merger with anti-spyware company D-Vasive.

* Samsung Electronics has sold shares in four companies, including ASML Holding and Seagate Technology, to free up money for additional investments for its core businesses.

* Good quarterly numbers from Adobe and Red Hat.

* Good half-year numbers from Esker.

* Mediocre year-end numbers from Analogic and Jabil Circuit.

* A half-year loss from Rocket Internet.

* A full-year loss from Seacom.

* The appointments of Mark Benjamin as president and COO of NCR; Paul Tafano as president and CEO of Benchmark Electronics; and Steven Zatz as CEO of WebMD Health.

* The resignation of Gayla Delly, president and CEO of Benchmark Electronics.

* The departure of David Schlanger, CEO of WebMD Health.

* An excellent IPO on Nasdaq by The Trade Desk, an ad-tech firm.

* Very good IPOs on Nasdaq by Apptio, a provider of cloud-based technology business management software; and Everbridge, a global software company that provides critical communications applications to keep people safe and businesses running.

* A good IPO on Nasdaq by Gridsum Holding, a Chinese provider of data analysis software.

Research results and predictions

South Africa:

* Providing Internet access in SA will generate R68.5 billion in revenue for service providers by 2020, up from R39.4 billion in 2015, according to PricewaterhouseCoopers.

EMEA/Africa:

* Annual IT spending in the Middle East and Africa (MEA) is forecast to reach $110.94 billion this year, representing year-on-year growth of 5.1%, according to IDC. It expects the market to total $133.56 billion in 2020, expanding at a CAGR of 4.8% over the 2015-20220 forecast period.

Worldwide:

* The worldwide public cloud services market is projected to grow 17.2% in 2016 to total $208.6 billion, up from $178 billion in 2015, according to Gartner.

* Worldwide enterprise videoconferencing equipment showed mixed results in 2Q16, with overall videoconferencing equipment revenue increasing 2% quarter over quarter, but down slightly (-0.4%) year over year, according to IDC. Total worldwide enterprise video equipment revenue in 2Q16 was more than $505 million, up from about $495 million in 2Q15. The total number of videoconferencing units sold in 2Q16 (104 209) increased 2.8% quarter over quarter and 5.2% year over year.

* The total worldwide PC monitor market shipped more than 30 million units in 2Q16, up 4.9% year over year and 4.6% quarter over quarter, according to IDC. It currently forecasts 118 million PC monitor units will be shipped for the full year 2016, and expects to see a year-over-year decline of 12.7% in worldwide shipments to 26.7 million units in the second quarter of 2017. By 2020, worldwide shipments are expected to be less than 100 million units, as the adoption of mobile devices at lower price points is expected to continue.

* Worldwide purpose-built backup appliance factory revenue grew 11.5% year over year, totalling $871.1 million in 2Q16, according to IDC.

Stock market changes

* JSE All share index: Up 0.3%

* FTSE100: Up 3% (highest weekend close since June 2015)

* DAX: Up 3.4%

* NYSE (Dow): Up 0.8%

* S&P 500: Up 1.2%

* Nasdaq: Up 1.7% (highest weekend close)

* Nikkei225: Up 1.4%

* Hang Seng: Up 1.5%

* Shanghai: Up 1%

Look out for

International:

* A possible acquisition by Salesforce.com of Twitter.

* The outcome of discussions between Apple and McLaren regarding an automotive tie-up.

* Google having to pay an Indonesian tax bill of over $400 million.

South Africa:

* Developments on the future of Broadband Infraco.

Final word

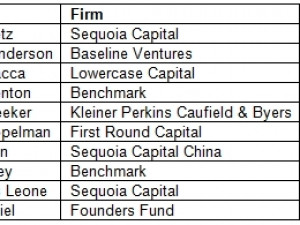

Forbes magazine has recently published its 2016 list of the world's smartest tech investors. The top 10 is as follows:

Share