Johannesburg, 10 May 2017

South African employers must take cognisance of the Compensation for Occupational Injuries and Diseases Act (COIDA), which replaced the Workman's Compensation Act in 1993 - specifically because of incentives for registration and payment, but also because of penalties for non-compliance. This includes criminal proceedings for misrepresentation of the facts.

COIDA is the process implemented to provide for the payment of compensation for disablement caused by occupational injuries, diseases sustained or contracted by employees in the course of their employment, and for death resulting from injuries and diseases.

Any employer carrying on a business in the Republic must register with the Compensation Commissioner. As part of registering for COID an employer is required to submit the annual Return of Earnings (ROE), after which the employer will pay an annual assessment fee.

CRS Technologies, a specialist provider of HR and Human Capital Management (HCM) solutions, is positioned to help clients with the successful assessment and submission of their ROE.

It is critical that employers not only understand the law and their responsibilities, but also what the implications are of both compliance and non-compliance.

To this end, CRS Technologies has the resources, expertise and market experience to advise and assist clients.

This service offering includes advice on best practice process to comply with legislation, registration with COID, assessing employee's remuneration earnings and identifying the risk associated with the type of profession, submitting ROE to the Department of Labour or the Rand Mutual Assurance (RMA), among others.

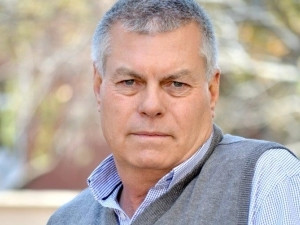

"We offer a full spectrum of services that will help our clients deal with the legislation appropriately in order to benefit. There is no doubt that non-compliance can have very severe consequences, and can cripple a business," says Ian McAlister, General Manager, CRS Technologies.

For more information and advice, click through to www.crs.co.za or e-mail info@crs.co.za

Share