Verizon's completion of its Yahoo acquisition and Amazon's Whole Foods deal dominated the international ICT market last week.

At home, it was fairly quiet.

Key local news

* Positive trading updates from Ansys and Naspers.

* HeroTel acquired two new wireless Internet service providers (WISPs), HX-Systems and Border Internet, making it the largest WISP in SA.

* Global professional services company Avanade is winding down operations in SA, and will service its South African clients via Accenture.

* The appointments of Jabu Moleketi as chairman of Vodacom Group; and Peter van Zyl as CEO of Stella Capital Partners.

* The resignation of Charles Pettit, CEO of Stella Capital Partners.

* The retirement of Peter Moyo, chairman of Vodacom Group.

Key African news

* The departure of Jean Claude Geha, Ericsson's president for the Sub-Saharan Africa region.

Key international news

Look out for the possibility of NTT selling Dimension Data.

* Amazon acquired Whole Foods Market, an upmarket grocer, for $13.7 billion.

* Cognizant bought TMG Health, a unit of Health Care Service Corporation, as part of an expansion of its strategic relationship with that company.

* Equifax purchased ID Watchdog, an identity theft protection and resolution services company providing solutions to the employee benefits marketplace.

* Fiserv acquired UK-based Monetise, a financial services technology firm, for £77 million.

* Orbcomm bought the assets of inthinc, a provider of best-in-class fleet management and driver safety solutions to a broad range of industrial enterprises.

* Tencent Holding led a $600 million investment in Chinese bike-sharing start-up Mobike.

* Trimble Navigation invested in privately held Innovative Software Engineering, an engineering and systems integration firm.

* India's third largest software services firm, Wipro, made an $809.7 million (26%) investment in IT consulting firm Drivestream.

* A group, led by Bain Capital and Japanese investors, has offered about $19 billion for Toshiba's semiconductor division, emerging as a leading bidder in the hotly contested auction.

* PLDT Communications and Energy Ventures, a unit of Philippine telco giant PLDT, has divested its remaining 25% equity interest in Beacon Electric Asset Holdings to Metro Pacific Investments Corporation for up to $581.8 million.

* Verizon has completed its $4.5 billion takeover of Yahoo.

* Wharf T&T, a Hong Kong ICT service provider, announced its new name - WTT HK.

* Good quarterly numbers from Finisar.

* Mixed quarterly figures from SAIC, with revenue down but profit up.

* Quarterly losses from Jabil Circuit.

* A full-year loss from Spotify.

* The appointments of John Flannery as CEO of GE; and Thomas McInerney as CEO of Altaba, the company created following Verizon's acquisition of Yahoo and the holding company for Yahoo's 15.5% stake in Alibaba and 35.5% of Yahoo Japan.

* The resignation of Marissa Mayer as CEO of Yahoo (following Verizon's completion of its acquisition of Yahoo).

* The retirement of Jeff Immelt as CEO (as of 1 August) and chairman (as of 31 December) of GE.

* The departure of Travis Kalanick, CEO of Uber, who has been put on an indefinite leave of absence.

* An IPO filing for Nasdaq from Compulab, a global developer and manufacturer of embedded computer systems, fan-less 'mini PCs', and a line of recently developed fan-less computing systems.

* A good IPO in India by Tejas Networks, a telecoms equipment maker.

Research results and predictions

EMEA/Africa:

* SD-WAN revenue in EMEA is expected to grow at an average pace of 92% per year to reach $2.1 billion by 2021, according to IDC.

* The Middle East and Africa personal computing devices market experienced a decline of 8.8% year-on-year in Q1 2017, according to IDC.

* Africa's mobile phone market started off 2017 with a drastic quarter-on-quarter decline, according to IDC. Overall shipments for Q117 year in Africa totalled 54.5 million units, down 8.2% on Q416. The prime driver of this downturn was a stark 17.6% decline in the smartphone segment, with shipments falling from 25.8 million units in Q416 to 21.2 million units in Q117.

* Total EMEA external storage systems revenue fell by 3.9% in Q117, according to IDC.

Worldwide:

* Growth in worldwide cloud-based security services will remain strong, reaching $5.9 billion in 2017, up 21% from 2016, according to Gartner.

* The worldwide hardcopy peripherals market grew 1.2% year-on-year, with more than 23.4 million units shipped in 1Q17, according to IDC.

* Worldwide spending on the Internet of things (IOT) is expected to grow 16.7% year-on-year in 2017, reaching just over $800 billion, according to IDC. By 2021, global IOT spending is expected to total nearly $1.4 trillion, as organisations continue to invest in the hardware, software, services and connectivity that enable the IOT.

Stock market changes

* JSE All share index: Down 2.6%

* FTSE100: Down 0.8%

* DAX: Down 0.5%

* NYSE (Dow): Up 0.5% (highest weekend close)

* S&P 500: Down 0.1%

* Nasdaq: Down 0.9%

* Nikkei225: Down 0.3%

* Hang Seng: Down 1.6%

* Shanghai: Down 1.1%

Look out for

International:

* EU's fine on Google regarding its search practices.

* The acquisition of Slack Technologies, a corporate chatroom start-up, possibly by Amazon.com.

South Africa:

* The possibility of NTT selling Dimension Data.

Final word

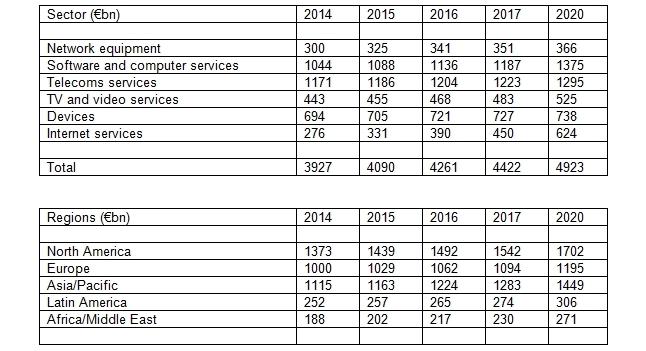

IDATE, a French NGO that tracks the global telecoms, Internet and media markets, has published its 2017 DigiWorld Yearbook. Unlike other industry research companies, IDATE includes TV and video services and Internet services separately in its figures.

Share