Just more than a year has passed since Facebook's hyped listing, the biggest since Google, and a good time to see how the stock has fared and whether investors who jumped on the bandwagon at listing have benefited.

Although not directly comparable, it is worth having a look at how business networking site LinkedIn has done on the market when compared against its social peer as a yard stick. LinkedIn and Facebook are the only two pure-play social sites that have been publicly listed.

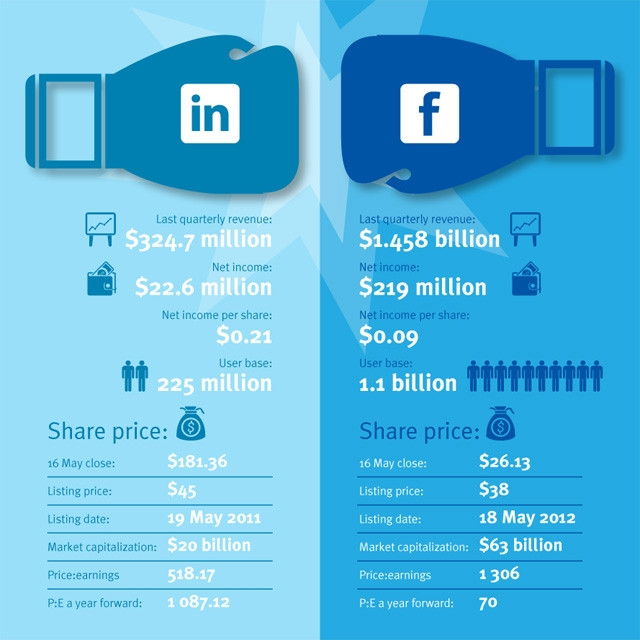

Based on the one-year forward price-to-earnings ratios for both the stocks, it looks like investors are betting on LinkedIn, while enthusiasm is waning for Facebook, which has seen its share price halve in the year since its listing.

Although LinkedIn is currently a fraction of the size of Facebook, with lower revenue and fewer users, its per share profit is higher. The forward price-to-earnings ratios show that shares in Facebook will become cheaper, while LinkedIn is expected to become more expensive, showing the interest the financial community has in the business networking site.

LinkedIn is currently trading at near record highs, and closed at $181.36 on 16 May, a 69% gain since Facebook's much-vaunted listing. Its record high was $192.03 at the end of March.

Facebook, however, has seen its stock lose more than a third of its value since its listing a year ago. Facebook burst onto the Nasdaq with an initial share offering of $38 a share, making it seven times more expensive than Apple at the time.

Becoming mundane?

Absa Investments analyst Chris Gilmour says Facebook is starting to be seen as boring and has limited usefulness, while LinkedIn is becoming cleverer; incorporating a lot of what Facebook used to do, and is far more business-oriented.

Gilmour says people go to LinkedIn to find jobs, while Facebook is frivolous, suggesting it has a limited time span. LinkedIn could become bigger than Facebook as it has a tangible reason for existing, he notes.

Mike Wronski, CEO of social media business intelligence firm Fuseware, has said Facebook has lost its novelty, and the injection of brands and advertising content into news feeds has seen strong negative feedback. While mobile usage is picking up, he said it comes with its own set of problems.

Growth is also slowing in developed markets, such as Europe and the US, although Facebook's subscriber base is still gaining in countries such as Brazil.

Vestact analyst Sasha Naryshkine points out that LinkedIn has real customers, some of which pay a premium to use its services, while Facebook relies on advertising for its revenue. He says Facebook stock has lost 31% since listing, while LinkedIn has gained 69% over the past year. "People are paying for what's going to happen in five years' time."

In the numbers

LinkedIn has been a star in a mostly disappointing social media sector, Reuters has reported. Yet, it noted it faces the same challenge confronting all Web companies, as consumers increasingly access the Internet through smartphones instead of PCs.

How much do you pay for the future?

The wire service says LinkedIn has introduced revamped mobile apps that will allow it to show ads on smartphones' small screens and it has been trying to entice members to spend more time on its site.

Facebook saw its share price come under increasing pressure over concerns that its revenue growth is stagnating. However, its latest results have showed it is able to gain advertising from mobile.

This had been cited by analysts as a concern, as more users moved to mobile, while the social network lacked a plan to make money from the shift.

Naryshkine says "everyone got very excited" when Facebook listed. However, he points out that it takes a while to build a business, and he is unaware of any other company that has gone from zero to a billion users in a decade. "How much do you pay for the future?"

The network has also launched new products, such as Facebook Home, which has had a lacklustre reception, and new advertising products such as Lookalike Audiences, Managed Custom Audiences, and Partner Categories, which help marketers improve their targeting capabilities on Facebook.

Facebook also continues to invest in its ad serving and measurement platforms, and has partnered with Datalogix, Epsilon, Acxiom, and BlueKai to enable marketers to incorporate off-Facebook purchasing data in order to deliver more relevant ads to users.

It also enhanced its ability to measure advertiser return-on-investment on digital media across the Internet through its acquisition of the Atlas Advertising Suite.

Vestact analyst Paul Theron has noted Goldman Sachs expects Facebook to double revenue by 2015, which augers well for the company's future prospects.

Share