Altron subsidiary, Power Technologies (Powertech), has entered into binding agreements to sell a controlling equity stake in Aberdare Cables South Africa to a Chinese cable manufacturer.

Hengtong Optic - Electric will buy a majority stake in Aberdare Cables SA, as well as a 100% equity stake in Aberdare Europe, comprising its Spanish and Portuguese operations, for approximately R1.2 billion in cash.

Powertech will retain a 17.5% interest in Aberdare Cables' local operation for two years, after which time agreement has been reached for Hengtong to purchase Powertech's stake at the same valuation as the initial transaction.

This transaction excludes the CBI Electric Aberdare ATC Telecom Cables joint venture in which Aberdare Cables holds a 50% equity stake, and the 49% equity stake in Alcon Marepha, which has been sold separately for R19 million.

"We have disposed of a number of assets in recent months as part of our strategy to focus on core businesses and reduce our exposure to manufacturing," says Altron CEO Robert Venter.

"The sale to Hengtong is the right move for Aberdare, as Hengtong is well-suited to support and develop the Aberdare Cables group through procurement benefits, product expansion, systems development, geographic expansion and technical expertise."

In February, the Competition Tribunal approved the disposal of Altron's Altech Autopage subscriber bases to telecoms operators Cell C, MTN and Vodacom, in a deal worth R1.5 billion.

Last December, Powertech entered into an agreement to dispose of its Powertech System Integrators business to Capitalworks Private Equity for R140 million.

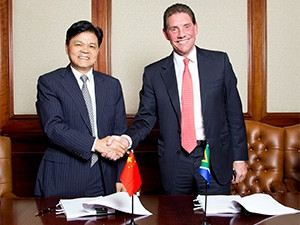

Hengtong Group chairman Genliang Cui says the purchase is an important event in Hengtong's internationalisation endeavours.

"Aberdare Cables is a strategic acquisition as it will increase our market presence and enable us to enhance our global competitiveness, particularly within emerging markets," he says.

Hengtong is the fourth largest cable manufacturer in China and one of the largest cable manufacturers in the world. The company is listed on the Shanghai Stock Exchange.

Founded in 1946, Aberdare specialises in the manufacture of low- and medium-voltage electrical cables for use in power generation, power transmission, power distribution, rural electrification, rail, petrochemical, mining, ports, airports, wholesale construction and domestic building environments.

The purchase will enable Hengtong to expand its international business in major markets where Aberdare operates, namely South Africa, Africa and Europe.

Share