Absa unveiled its banking app at an event in Johannesburg yesterday, and it is currently available to Absa customers using Android and iOS.

According to Absa retail bank's head of digital and payments, Adrian Vermooten, the bank has developed a solution built for mobile phones and tablets that combines appealing visual elements with ease of use. He stressed that the application is native, rather than an extension of the bank's online experience.

Absa's app comes 21 months after First National Bank launched SA's first banking app. Absa missed its self-imposed Q1 2013 deadline by 10 days. According to the Absa team, the app has been in the making for about two years and has been used internally by Absa staff members since the end of 2012.

This offering is designed "for the finger", said Vermooten. "We tried to make it no more than two clicks to do any task."

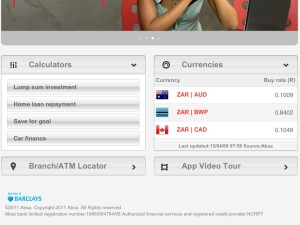

The app is fully integrated into a user's contacts, and according to Vermooten, users can access their entire Absa portfolio through the app. With the offering, Absa focused on how to service everyone, from the individual to households and business clients, Vermooten said, adding that consumers can use the app to access various accounts on a single device. The app is available free to Absa customers as part of the bank's Value Bundles offering.

An integrated GPS allows users to access a branch or ATM locator, and the landing page provides the option to view video tutorials on how to use the app, removing the need to visit a branch should problems be encountered.

Although use does not require two phase authentication, Vermooten pointed out that the app is linked to the user's Internet banking profile. This means it will function in the same way as the bank's conventional Internet banking; sending SMS notifications to the account-holder every time the account is accessed or a transaction is made.

The current version of the app will be updated every eight weeks, he said, adding that a BlackBerry-compatible offering is planned as one of the first of these updates. The app is currently available in English and Afrikaans, but features multi-language capability; another area that will be developed in coming months.

This application is intended to offer customers quick transaction capability, concluded Vermooten."This app is about using the five minutes spare time you have in your day to get the transaction done."

Share