China has overtaken the US to become the world's top smartphone and tablet market, according to new data.

Mobile-analytics firm Flurry says, in just a year since it initially reported that China had become the fastest growing smart device market, the country's rapidly growing middle class has led it to quickly close the gap with the US, and now has more active iOS and Android connections.

Flurry says: "In this new era of mobile computing, sparked by a confluence of powerful innovation across microprocessors, cloud storage and network speeds, Apple and Google have helped create the fastest adopted technology revolution in history, 10X faster than that of the PC revolution and 3X that of the Internet boom. And now, as the largest and fastest modernising country in the world, Chinese consumers lead that revolution."

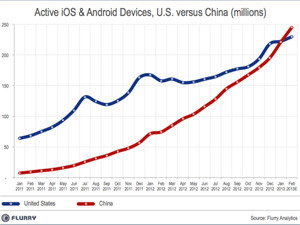

According to Flurry's data, China and the US had roughly the same active smart device installed base in January 2013, with 222 million in the US versus 221 million in China.

"We use a model to project the final February 2013 installed base for each country based on historical growth trends as well as the number of detected devices per country through the first half of February. Flurry estimates that by the end of February 2013, China will have 246 million devices compared to 230 million in the US."

Flurry says for this report, it used its entire data set, which tracks 2.4 billion anonymous aggregated application sessions per day across over 275 000 applications around the world. The research firm says it can reliably measure activity over more than 90% of all smart devices globally.

"We also conclude that the US will not take back the lead from China, given the vast difference in population per country. China has over 1.3 billion people while the US has just over 310 million," says Flurry. It adds that the only other country that could possibly overtake China in the future is India, which has a population of 1.2 billion.

"However, with only 19 million active smart devices in India, China will not likely see competition from India for many years."

The smart device growth rate in China is also well above that of the US. Between January 2012 and January 2013, 55 million new smart devices were activated in the US, compared to 150 million added in China over the same period.

The US and China both have more than five times the active installed base of the UK, which is currently the third largest smart device market in the world.

Power shift

For a long time, the US has been seen as the most important market for smart devices, but the power is clearly shifting. In announcing its fourth quarter results recently, Apple said iPhone sales had more than doubled in greater China. Apple CEO Tim Cook has also indicated the company would be focusing on the region as its next big growth driver, and would begin detailing its results in that country. Apple's revenue in China in the fourth quarter totalled $7.3 billion - a 60% increase year-on-year.

While Apple's iPhone is seeing substantial growth in China, the market is heavily dominated by the Android OS. In December, figures from China-based Analysys International, showed Android controlled about 90% of the total Chinese smartphone market. It is, however, noted that due to Google's issues with the Chinese government, most Android devices come without many Google services - including the Google Play store.

Figures from another research firm, Kantar, which measures smartphone sales in urban China and includes a larger proportion of high-end devices, shows Android still dominates at 70% market share. Apple's iPhone clearly has a strong niche in urban China though, with about 20% market share.

Overall in the Asia/Pacific region, according to the IDC, Samsung and Lenovo are the top two smartphone vendors, followed by Chinese brand Coolpad at number three, ZTE at number four, and Huawei at number five.

In terms of tablets, in November last year, Analysys pegged the iPad's share of the Chinese tablet market at 71.4%. Lenovo had the second largest market share, at 10.5%, followed by Chinese company Ereneben at 3.6% and Samsung at 3.5%.

Share