* Data shows lending spree ahead of fee caps, as taps now tighten.

* Banks account for the lion's share of unsecured loans in the market.

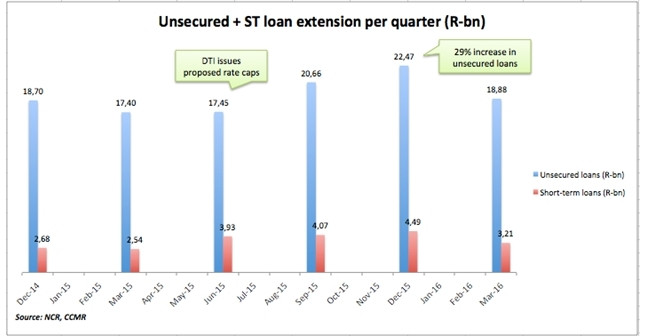

In the six months after government issued proposed caps to charges on loans, unsecured credit ballooned by almost 30%, suggesting that lenders were maximising prevailing high interest rates before lower legal limits rained on their parade.

Unsecured lenders embarked on a lending spree in the months before caps to interest rates and fees came into effect, data from the National Credit Regulator's (NCR) Consumer Credit Market Reports (CCMR) reveal.

From levels above R21 billion for the quarter to December 2013, unsecured credit growth fell during 2014 and the beginning of 2015, before spiking upwards for the six months to December 2015 - immediately after the Department of Trade and Industry (dti) first published the draft recommendations on caps to rates and fees towards the end of June 2015.

It was proposed that the maximum prescribed rate on unsecured credit transactions be slashed from 32.65% to 24.78%.

Short-term loans, which have also seen interest rates reduced, show a similar increase.

Credit providers warned of the unintended consequences of this dramatic reduction in interest rates, which they said would see the credit taps tightened and consumers forced to source loans from unregulated loan sharks.

They then promptly went on a lending spree, presumably to grant as much credit as they could at the prevailing higher interest rates.

Larger loans granted over a longer term picked up during this time, according to the NCR's data. Following widespread consultation with industry, the maximum prescribed rate on unsecured loans was changed to the repo rate plus 21% (currently 27%).

The final regulations were published in November 2015 and came into effect in May.

Pullback in unsecured lending

Unsurprisingly, new unsecured loans granted in the first three months of this year have fallen by 16% to R18.9 billion, as credit providers pulled back following a bumper six months and in a weaker economic environment.

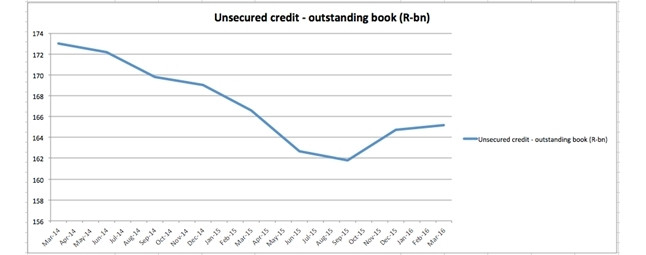

That lending ramped up in the months following the release of proposed caps to rates and fees is also reflected in the total outstanding gross debtors' book. This provides a snapshot of the total unsecured loans still to be repaid at a given point in time.

This book was on a declining trend, but has spiked upwards following last year's lending (borrowing?) spree. From R162 billion at September 2015, it ended March 2016 at R165 billion.

While some credit providers have cautioned that short-term and payday lenders are filling the gap left by a contraction in unsecured credit, the NCR counters that short-term credit is unlikely to fill such a large gap.

For the three months to March 2016, R3.2 billion in new short-term credit was granted, a decrease of 28.5% from the previous quarter. Short-term credit refers to loans of less than R8 000 granted over terms of six months or less.

Almost 52% of the amount granted was for loans of less than one month, according to the NCR's head of statistics, Ngoako Mabebe. Some 63% of the numbers of accounts granted were for one month or less, he said.

"Larger credit providers account for a considerable chunk of the value of short-term loans being extended," Mabebe told Moneyweb.

A number of smaller credit providers including, for example, those lending out of the boots of their cars, continue to go unaccounted for.

In an attempt to curb consumer abuse, all credit providers are now required to register with the NCR.

Previously, entities needed to either have loan books amounting to R500 000 or 100 credit agreements in order to have to register. This threshold has been scrapped.

"Consumers are advised to obtain credit only from duly-registered entities, as doing so will advance their rights as provided in the National Credit Act. Consumers who are in doubt about the registration status of any entity can contact the NCR for verification," said Nthupang Magolego, senior legal advisor at the NCR.

Share