The Independent Communications Authority of South Africa (ICASA) is launching yet another study to find out how expensive SA's mobile data prices are; this time comparing us to other countries.

The regulator says it will "undertake a comprehensive international benchmark study on South African mobile retail data tariffs against comparator countries". It made the statement as part of its bi-annual report on the analysis of tariff notifications. The report was released this week and covers the period of 1 January to 30 June 2017.

"The objective of this [international benchmark study] is to compare South African data bundles with other comparator countries to assess the level of competitiveness of South African data bundles.

"This report is expected to clarify the concern raised by the general public about South African mobile data prices remaining far more expensive compared to comparator countries. This study will inform ICASA's ex-ante regulatory intervention into the data prices in line with international best practice," ICASA says.

This is the third study initiated into the price of mobile data by local authorities in as many months. In July, ICASA began an inquiry into the cost to communicate and the Competition Commission followed in August with its own inquiry into the high price of data services in SA. The ICASA inquiry is due to be completed by March 2018, while the Competition Commission will be done by August 2018.

Consumer activism is one of the reasons government and regulators are feeling pressure to bring local data prices down. This after the #DataMustFall slogan became a social media chant last year when radio personality Thabo "Tbo Touch" Molefe led a campaign that got consumers hot under the collar.

The debate reached all the way to Parliament's portfolio committee on telecommunications and postal services, which heard submissions from government, civil society organisations, telecoms operators and the public about the cost to communicate in SA.

The analysis of tariff notifications report goes into detail on the South African market and highlights the different tariff plans (prices and product offerings) during the period.

"It is ICASA's view that the publication of the report would enable consumers to make an informed choice, in terms of tariff plan preferences and/or preferred network providers based on their different offerings," it says.

Bundle comparison

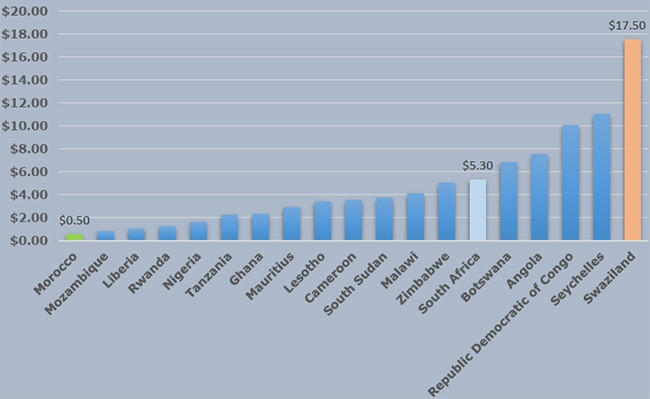

For its latest bi-annual report, released this week, the regulator conducted a benchmarking exercise on the prices of 500MB, 1GB and 2GB data bundles offered by mobile operators in Africa to compare those to SA. It focused on the Southern African Development Community (SADC) region (where pricing information was readily available) and other African countries where South African mobile networks have a footprint.

In terms of the price of 500MB of data, SA did not fair that well when compared to African peers. According to ICASA's data, in the first quarter of 2017, SA ranked number 14 out of the 19 countries compared.

Swaziland had the most expensive 500MB data bundle at a cost of $17.50 (R234), while the cheapest was in Morocco, where it cost just $0.50 (R6.68). Second cheapest was Mozambique at $0.80 (R10.69) per 500MB. SA's cheapest 500MB bundle, in comparison, was priced at $5.30 (R70.85) which is approximately three times cheaper than Swaziland but 10 times more expensive than Morocco. A 500MB data bundle is also more expensive than SA's price in Botswana, Angola, the Democratic Republic of the Congo and the Seychelles.

For the comparison of the cost of 1GB of data, ICASA used figures from Research ICT Africa (RIA), an ICT policy and regulation think tank, which has an index comparing the cheapest price for 1GB of data ? based on prepaid data top-ups or bundled top-ups ? in Africa by country.

According to RIA's data for the first quarter (Q1) of 2017, SA was ranked 14th out of 26 benchmark countries. South Sudan's prices were the highest in Q1, with a 1GB bundle costing $131.42 (R1 757). This was followed by Swaziland at $34.43 (R460) and Zimbabwe at $30 (R401). Ghana and Mozambique had the cheapest 1GB bundle on average at $2.27 (R30.35).

In comparison, 1GB of data in SA in the quarter cost $7.49 (R100). Among the cheapest were Tanzania, Rwanda and Nigeria.

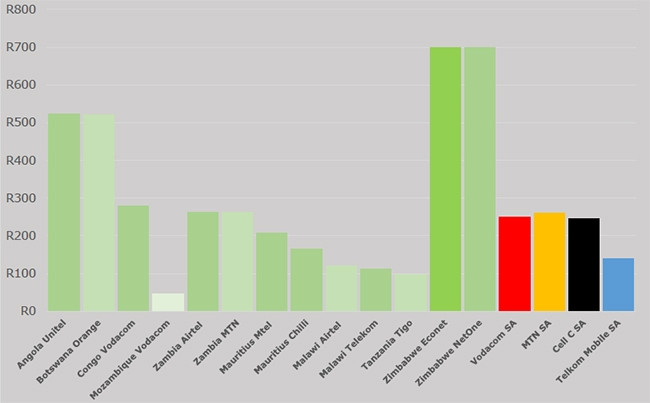

However, SA's competitiveness improves when looking at the cost of a 2GB bundle. ICASA chose to compare the price of 2GB bundles in SADC countries, where information could be found on operators' Web sites. This showed that on average, the data prices in other SADC countries are relatively higher than those of SA's operators Vodacom, MTN, Cell C and Telkom Mobile.

"However, there are a few instances where operators in Mauritius, Malawi, Mozambique and Tanzania are relatively cheaper than South African operators by up to 80%," ICASA says.

ICASA says the snapshot of data prices presented in the benchmarking of SA's 500MB, 1GB and 2GB data prices against other African countries "signals that SA's data prices are not the cheapest".

"In addition, the price differentials between the in-bundle and out-of-bundle data rates are excessive (as high as 4 000%), which disadvantages customers, who are unable to afford to buy a recurring/monthly bundle upfront," it says.

"Other factors, such as mobile network reach/coverage, service quality (ie, speed and latency), technology type (eg, LTE), and the price of the mobile devices were not taken into account in conducting this analysis," ICASA says.

However, network coverage is an important factor to consider because many African countries do not have the advanced infrastructure availability required to support data traffic on a more nation-wide scale. Despite lower prices, many African markets still have poor coverage and service quality. In some cases, old generation networks like 2G remain the only networks deployed. In comparison, SA has extensive 3G and 4G networks rolled out.

Regulatory interventions

The authority says it has undertaken various initiatives to address calls for regulatory interventions towards a potential reduction of data charges.

The planned international benchmark study is included under "short-term initiatives" that could be implemented in six months or less. ICASA says it has also established a task team, together with the National Consumer Commission, to address challenges that have been raised by consumers with regards to the business rules of mobile data services, particularly in terms of the expiry of unused data bundles and the differentials between in- and out-of-bundle rates.

This process resulted in the amendment of the End-user and Subscriber Service Charter Regulations, with new draft regulations published in August.

Medium-term initiatives, which can be implemented in 12 months or less, include ICASA's market inquiry into the broadband services markets. They also include engagements with the Department of Telecommunications and Postal Services (DTPS) with regards to the policy directive on the rapid deployment of infrastructure, which ICASA says "has a direct and indirect impact on the cost to communicate".

DTPS director-general Robert Nkuna told ITWeb last month that the department's rapid deployment of electronic communications infrastructure strategy was ready to be submitted to Cabinet for approval.

Long-term initiatives, which will take longer than 12 months, include the regulator's inquiry into priority markets in the electronic communications sector.

Share