In a world where products and services are becoming increasingly commoditised and reduced to ones and zeros, surely the concept of 'business strategy' remains a key differentiator? Not so, says EOH's Asher Bohbot. As founder and CEO of the technology giant, he's certainly not pinning EOH's hopes on having a smarter strategy than its peers.

"Strategy is becoming less and less of a differentiator," he says. "What is harder to mimic is the execution - the ability to deliver. For this, you need far more complex activities and coordination."

It is this central tenet, he believes, that will separate the diversified tech group (now employing over 6 000 staff), from the rest of the market. Considering business performance, it's hard to argue with the straight-talking Bohbot. In 2013, EOH was the best performing share among all mid- and large-caps on the JSE - 113 percent up.

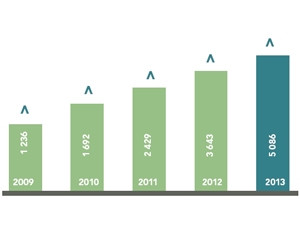

For its financial year to end-July 2013, headline earnings per share were up 34 percent, to 339c. Revenue was up 40 percent to R5.1 billion.

Just three years ago, in 2010, EOH's revenue was R1.7 billion. At the time, among large IT firms, EOH may not have been the first name to come to mind - it was often eclipsed by better-known peers packing a more powerful marketing punch.

But the landscape has changed. "Our growth throughout our existence has been a combination of organic and - where appropriate - acquisitive," Bohbot says.

There may have been no landmark deals setting the market alight, but EOH's 2013 numbers were certainly boosted by a number of key acquisitions in niche areas.

Right culture

Bohbot says the secret of EOH's success in recent years has been in establishing the right culture within the organisation and its various operating divisions. Healthy client relationships and quality technical execution can only stem from the right culture, value systems and ethics, he maintains.

"We ultimately have no assets other than our people; that's the nature of being in a services industry. There's always a strong correlation, in any business and any industry, between the value of a company and the quality of its people," he adds. "The correlation really is 100 percent."

Whether it's hiring new managers, absorbing interns into the organisation, or acquiring a new company, EOH's key considerations are around ensuring a cultural fit with the organisation. Bohbot says every new person who enters the organisation to some degree impacts and changes the identity of EOH.

EOH has differentiated itself, leading to significant contract wins in industry and government.

Steven Ambrose, StrategyWorx

StrategyWorx CEO Steven Ambrose agrees that the stars do seem to be aligning for EOH at the moment: "They've been building a solid services and complementary technology company for many years, and with controversies and management shuffling of some of its competitors, in the past couple of years, EOH has been able to capitalise on the changes in the market."

Ambrose adds that EOH has clearly recognised the huge waves of technology disruption currently facing CIOs, and positioned itself more appropriately than many of its peers - with the cloud revolution being the clearest example of this.

"Combined with coherent, integrated services and systems offerings, EOH has differentiated itself, leading to significant contract wins in industry and government."

Independent ICT analyst Paul Booth describes EOH's 2013 as a 'phenomenal year', and, while expecting growth to continue, Booth believes it will be extremely difficult for EOH to emulate its own recent performance.

While looking at the next acquisition targets, he says the organisation will have to deal with unwinding overlaps and conflicts resulting from its string of recent takeovers. "There certainly needs to be some consolidation and restructuring in a number of areas. It would be untenable to have numerous sales calls for one client, for instance."

It's also critical for EOH to form a unified marketing message or approach to the market. Considering the breadth of diversity in its operations, this is something EOH has historically struggled to achieve, Booth adds.

Competition

For Bohbot, the strategy (as 'undifferentiated' as it may be) is ensuring clients make the most of key technology trends like cloud and mobility. Irrespective of market conditions, he believes clients will always need more and more IT infrastructure, and will always require maintenance contracts.

Bohbot also sees opportunity in helping clients to open up new digital touchpoints with their customers, digitising workflow systems and capitalising on advanced analytics to improve their customer experience.

IT is pressurising and even morphing industries, he says, alluding to the various cross-overs starting to become apparent between retailers, telcos, banks, and ISPs, for example.

"The market environment today sees clients that are far more knowledgeable and sophisticated than years ago. They want relevancy to their business sector, to their specific challenges." As innovation cycles speed up, clients are also becoming more sensitive to costs, more conscious of extracting the most value from any technology, he adds.

There certainly needs to be some consolidation and restructuring in a number of areas.

Paul Booth, ICT analyst

And while Ambrose points to the risks of increased competition in IT services - particularly in the form of new, global, offshore entities - Bohbot is unfazed by incoming international competitors: "We're fully local - we understand the environment and the client needs. So we have our approach and our philosophy, and if we stick to it and execute on it, then the growth will continue."

EOH is certainly positioning itself as a pan-African entity.

"We see ourselves as an African organisation," says Bohbot, adding that the company plans to continue growing into various new territories in the coming years.

The market seems to welcome EOH's appetite for expansion. Trading at a historical price - earnings ratio of about 24 (at the time of writing), the stock seems to have gone through a re-rating - attributed to the fundamental strength, scale and diversity in the business, as well as its future prospects.

But Bohbot says the company (and its acquisition roadmap) will not be driven by shareholder sentiment. "The market response is an indicator that we're doing something right - for 15 years in fact, and not just one quarter. But frankly, the only thing we can focus on is ensuring the business is fundamentally strong."

There's a quiet simplicity in Bohbot and his leadership team's approach. This no-nonsense, no-frills method focuses on quality people and quality work, rather than blue-sky business and technology strategies. It's this grittiness that saw EOH rise to become the 'darling' stock of the Alsi in 2013. And it may well see it staying there, or there about, in 2014.

First published in the March 2014 issue of ITWeb Brainstorm magazine.

* Article first published on brainstorm.itweb.co.za

Share