Datatec, which is on track to hit $6.4 billion in income due to its diversification and acquisitive strategy, has bolstered its Logicalis unit.

The dual-listed ICT company says in a statement Logicalis bought Trovus, a UK business intelligence consultancy, which provides business insight solutions, professional services and managed services to large enterprise clients.

Datatec did not disclose the value of the deal.

It says Trovus' analytics solutions equip its customers with rapid access to actionable business insights from existing data within their own businesses. Datatec explains its offering is complementary to Logicalis' Business Analytics and Information Management unit.

The combination will enable Logicalis to increase the depth of its business intelligence engagement model, while retaining its focus on licence and supporting infrastructure sales.

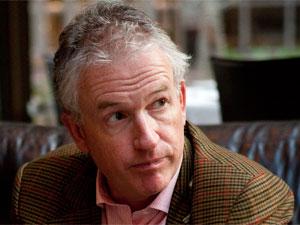

Datatec CEO Jens Montanana explains buying Trovus "supports our strategic goal of growing annuity revenue streams within the business.

"Trovus has highly specialised skills. The acquisition will strengthen Logicalis' business analytics and information management offering to existing customers and open new doors in the information insights and big data markets."

This deal is the latest in a line of additions to Logicalis, with Datatec having added Inforsacom Holding, a German ICT services and solutions provider, last December. Inforsacom is a provider of database, storage and infrastructure solutions and services, with operations across the major economic centres of Germany.

Logicalis is Datatec's second biggest revenue-spinner, after Westcon, and has steadily been growing its top line. For the full year, Datatec expects to hit revenue of $6.4 billion, compared to $5.7 billion last year, while underlying earnings per share should come in at between 41USc and 43USc.

Its results should be published next Wednesday.

Share