The perception of a corrupt business environment in Africa has long been seen as a barrier to entry for those who want to trade on the continent. But as business opportunities are starting to boom, especially across sub-Saharan Africa, local businesses, new multinationals and governments need to put measures in place to create the kind of business culture that will inspire business confidence and improve ease of doing business in Africa.

Clayton Thomopoulos, Director of Forensic Advisory and Solutions at professional services firm Deloitte South Africa, says companies and governments can only root out fraud and corruption if they employ innovative electronic tools to identify risks and then put measures in place to plug these gaps.

Speaking from more than 17 years' experience as a forensic expert in the public and private sector, Thomopoulos has seen that fraud and corruption often stem from an official or employees' failure to disclose financial interests where they are able to profit unlawfully.

The risk of third-party interests

"One of the major fraud risks that any organisation faces is the opportunity for fraud and corruption by employees with third-party interests, generally without disclosure to their employer," says Thomopoulos.

"If an employee (especially at management level) has a financial interest in an entity with whom the organisation is transacting, then it may follow that the employee may be looking after his own interests rather than those of the organisation."

Undeclared financial conflicts of interest pose several risks to employers. "Should an employee be deriving income from other sources, they spend significant amounts of time focused on 'non-employer' related services. This can lead to abuse of company systems, telephones and time," says Thomopoulos.

"Apart from the financial risk associated with conflicts of interest, there is also a significant reputational risk to the employer predominantly due to the fact that undetected conflicts of interest typically indicate poor internal controls," says Thomopoulos.

Director at Deloitte and Head of Deloitte Legal in South Africa, Dean Chivers, also adds this advice: "Undisclosed conflicts can lead to further compliance issues, such as potential breaches of competition law, labour law and regulation in the supply chain space."

Thomopoulos maintains that although employees are the first line of defence against fraud in an organisation, they are often also an organisation's biggest fraud risk.

A company's policy should ensure that all employees declare their external business interests and other relevant information that may reflect a potential conflict of interest, says Thomopoulos.

An African view on fraud and corruption

Governments in sub-Saharan Africa have announced various initiatives and have signed various international protocols to root out corruption in various sectors. Examples include Kenya and Zambia's willingness to sign the Extractive Industries Transparency Initiative (EITI) to promote revenue transparency and accountability in the extractive sectors, and South Africa's signing of the Sustainable Mining Industry framework to stamp out fraud and corruption in mining.

However, the 8th Global Corruption Barometer published by Transparency International shows that respondents in 21 African countries (including North Africa, sub-Saharan Africa and Indian Ocean islands) think that corruption and lack of transparency is getting worse in their countries. Only three countries - Sudan, South Sudan and Burundi - felt that transparency improved from 2011/12 to 2012/13.

The global survey draws on 114 000 ordinary people's direct experiences with corruption and lack of transparency in 107 countries. About 1 000 people were surveyed per country.

In this survey, 43% of respondents in South Africa said that in their dealings with the public sector, it proved "very important" to have personal contacts to get a deal done, compared to only 3% who said it was not important at all. In South Africa, 47% of respondents said they paid bribes.

In Kenya, personal contacts in the public sector were considered marginally less important, with 37% of respondents saying it was "very important" to have contacts in the public sector and 11% saying it was not important at all to have contacts to get things done.

Nigeria is somewhere in the middle, with 39% of respondents in this West African country considering it important to have personal contacts in government while a tiny 3% said it was "not important at all".

Significantly, in all of these countries, there was a strong belief that civil society could play an important role in stopping corruption. In Nigeria, over 40% of respondents believed this, and in Kenya and South Africa, over 60% believed civil society could help put an end to fraud and corruption.

Practical solutions for an electronic age

Thomopoulos and his team of forensic experts believe companies and governments need practical solutions to really take ownership of these challenges and tackle fraud and corruption in their ranks. They need a smart and simple electronic financial disclosure tool that can flag conflicts of interest, for instance when a senior official or a relative of the official is the director of a company that a contract is being awarded to.

Thomopoulos says: "The only way to effectively combat fraud, corruption and conflicts of interest is through the use of technology. Verification of information acts as a huge deterrent to employees and individuals considering potentially unethical business relationships. It stands to reason that the only manner in which verification can be entrenched within an organisation is through the analysis of data."

The trouble is that many organisations still use paper-based systems to record employees' declarations of their financial interests. "This makes it difficult to compare the disclosures made to other databases such as the organisation's supplier database, client database and for testing against the database of directors and members of companies and close corporations maintained by the Companies and Intellectual Property Commission," says Thomopoulos

Other risks of paper-based systems are that employees can claim that a disclosure was made, but that the document was probably misplaced, and that data is hard to verify manually," explains Thomopoulos.

"The receipt of gifts or sponsorships from suppliers is something that needs to be closely monitored and, unfortunately, a paper-based gift register has now become ineffective. By effectively harnessing data derived from the financial declarations, companies can effectively analyse trends in gifts and sponsorships."

A financial interests disclosures tool that works

To address the need for smart electronic solutions for forensic challenges, Deloitte has developed a set of tools and services in the area of corporate forensics, which are designed to expose the major fraud risks, using the latest technology.

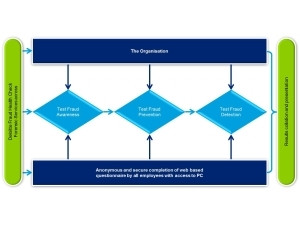

These tools include a Forensic Case Management System to manage case load and reporting, the anonymous, Web-based Deloitte Fraud Health Check, and a basic tool that underpins all others - the online Financial Interests Disclosures tool.

The Deloitte Financial Interests Disclosures tool automates the capture and analysis of employees' financial interests for ease of implementation and to enhance verification and detection of anomalies.

"Deloitte's automated Web-based tool and process allows employees to submit their financial interests electronically. This, in turn, will allow the organisation to readily verify information and thus harness the broad range of benefits that such a system will provide," says Thomopoulos.

Thomopoulos also warns that organisations' codes of conduct should provide for the full declaration of all gifts and sponsorships received that are above a certain threshold amount.

Electronic data comparisons can also show employers which of their suppliers are plying the employees with the most gifts, says Thomopoulos.

Electronically submitted financial interests disclosures can be independently verified and checked. The system also allows employees to access their company policy of conflicts of interest and gift policy.

With a list of a company's employees, their particulars and dependants, together with an electronic database that contains supplier details, the Web-based financial disclosure system requires any number of specified employees to send annual declaration or at intervals required by their employer. Where a response is not received within a set timeline, the employee is reminded via e-mail and the matter is escalated until a response is received.

"By harnessing the power of technology, entities can not only expedite their financial disclosure process but also enhance their detection rates in respect of potential conflicts of interest. The system in itself acts as a deterrent as employees are aware that the information they are providing will be verified and anomalies will be investigated."

The promotion of electronic verification in any environment serves as a catalyst to improved fraud risk management, investor confidence and sound governance," says Thomopoulos.

Thomopoulos concludes: "Improved transparency and better management of risk is what the Africa business environment needs - over and above high-level policies in international transparency agreements, it needs practical on-the-ground solutions. If we want to make this the most exciting place to do business this decade, we also need to make it one of the safest."

With offices in more than 30 African countries and services available in all but two African countries, Deloitte is an invaluable ally to companies and governments that want to stamp out fraud and corruption in their ranks, in new markets and across borders.

Share

Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu, a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.com/about for a detailed description of the legal structure of Deloitte Touche Tohmatsu and its member firms.

"Deloitte" is the brand under which tens of thousands of dedicated professionals in independent firms throughout the world collaborate to provide audit, consulting, financial advisory, risk management and tax services to selected clients. These firms are members of Deloitte Touche Tohmatsu (DTTL), a UK private company limited by guarantee. Each member firm provides services in a particular geographic area and is subject to the laws and professional regulations of the particular country or countries in which it operates. DTTL does not itself provide services to clients. DTTL and each DTTL member firm are separate and distinct legal entities, which cannot obligate each other. DTTL and each DTTL member firm are liable only for their own acts or omissions and not those of each other. Each DTTL member firm is structured differently in accordance with national laws, regulations, customary practice and other factors, and may secure the provision of professional services in its territory through subsidiaries, affiliates and/or other entities.

(c) 2013 Deloitte & Touche. All rights reserved. Member of Deloitte Touche Tohmatsu Limited.

Editorial contacts