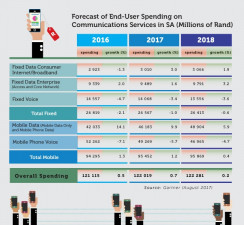

End-user spending on communications services in SA is forecast to total R122 billion in 2017, a 0.7% increase from 2016.

This is according to market analyst firm Gartner, which measured legacy access service revenue from end-users, including voice and data, fixed and mobile, as well as enterprise and consumer.

Gartner studied the public reports of the largest 30 communications service providers by revenue in 2015-2016 and worked out the likely proportions of these revenue areas.

"The forecast growth rate is slight, mainly due to shifts to less expensive legacy service offerings as competition heats up," says William Hahn, principal research analyst at Gartner.

"It's likely to remain fairly flat in 2018 as increased competition in the access services segment erodes prices as fast as, or faster than, adjacent market revenues replace it."

Gartner notes this slight growth in spending on communications services in SA in 2017 compares favourably with the global market, which is forecast to show a 0.2% decline.

It adds that business customers are applying effective pressure to service providers to get shorter contracts, lower and more accurate pricing, and shifting to software-defined architectures that improve their ability to order only what they need at the time growth occurs.

Gartner expects to see increased Internet channels to branch offices, and the development of hybrid wide area networks as service providers improve fixed coverage and access to public clouds.

It points out that growth in the Internet of things promises a limited source of additional revenue for service providers, but ecosystems in areas such as automotive, manufacturing, healthcare and smart cities will require extensive expertise in professional services, consulting and support to deliver solid growth. Connectivity alone will become a commodity, just as with legacy subscribers.

The market analyst firm says end-user mobile data and voice spending is forecast to total R95.5 billion in 2017, a 1.2% increase from 2016.

"Spending growth in this segment is slowing, mainly due to increased competition between the major providers as market penetration increases, as well as decreased emphasis on voice usage," notes Hahn.

He believes data prices will continue to fall just as voice pricing does, driven by the competitive factor, the increased availability of bandwidth and other factors.

"But communications service providers in SA, just as around the world, will seek to combine and bundle services, including adjacent services, into a single convenient price point which tends to obscure the impact of such trends."

In SA - just as in the global market - the decline in spending on voice services (5.7% in 2017) offsets gains from an increase in data connections.

"Many users engage in substitute messaging, such as instant messaging chat, and the predominance of prepaid billing can accelerate this trend," Hahn notes. "As legacy pricing comes under increased pressure, communications providers must expand the range of devices offered to end-users to win the churn battle, incentivising more data use with plans, value-added content and customer service."

According to Gartner, South African providers achieved good growth overall in 2017, following some tough years, including a particularly difficult 2015.

It notes they achieved overall revenue growth, although growth in the average revenue per user slowed, due to new cheaper devices coming onto the market and legacy offerings encountering fierce competition.

"It's vital that these providers move into adjacent areas that can produce synergies with existing access services. This will enable them to climb the value chain by offering related support, consulting, digital media content and more, either through direct acquisitions or partnerships. The connected home, smart city and automotive sectors are expected to exhibit solid growth, but not every provider will be well-suited to them," says Hahn.

Share