To cash or not to cash?

In 2017, we celebrate the 50th anniversary of the ATM. With many countries envisioning a cashless society, we find ourselves asking what is the future of the ATM? The World Payment Report 2015 indicated that global non-cash payments grew at a rate of 7.6% in 2013, with emerging Asia at 21.6%. The non-cash payments consistently grew across all markets.

Even as the global volume of non-cash payments continues to grow, transactions conducted in cash still dwarf the non-cash transactions. This is true of even the most mature economies like the USA and the Euro Zone.

Globally, it is estimated that $21 trillion, or 43%, of consumer payment transactions are still conducted with cash, and an estimated 357 billion banknotes are in circulation[i], with about 150 billion notes being printed every year to replace those taken out of circulation. Without a doubt, cash continues to persist in the world of payments.

The ATM will therefore remain a vital touch-point between banks and their customers. By 2020, another million ATMs will come online around the globe, raising the total to 4 million. The ATM market is projected [ii] to see 37% growth in ATM installations between 2014 and 2020 (Retail Banking Report - RBR). However, the ATM industry is heavily affected by digital disruption and is undergoing a churn. The ATM manufacturers are looking at redesigning and reinventing themselves to stay relevant in the era of non-cash payments.

Evolution of ATMs

Once providing a purely cash-dispensing service, ATMs have significantly evolved to perform a wide range of financial services - depositing cash and cheques, paying bills, mobile phone top-ups, dispensing postage stamps, ticketing, loans, investments, IPOs and purchase of insurance premiums. Some more unusual services available at ATMs include offering sacrificial goats (Indonesia), dispensing gold (UAE), funeral plans (South Africa) and even cashing in/cashing out virtual currency Bitcoin. ATMs certainly are tailoring their services to customer demands.

While banks in emerging markets are spreading their networks and adding features to ATMs, in developed markets they are looking at advanced ATMs as a cheaper alternative to branches. Thus, ATM as a delivery channel is assuming greater significance.

Trends in the ATM marketplace

The ATM market place has been dominated by the 'Big Three' - NCR, Diebold, and Wincor - for a long time. Together, they hold 61% market share. But that is changing. Despite strong shipment figures, US firms NCR and Diebold and Germany's Wincor Nixdorf, are gradually losing installed base market share to their Asian rivals - Nautilus Hyosung (South Korea), Hitachi-Omron and OKI (Japan) and GRG (China).

Moving away from hardware-centric strategies

With the architectural transformation from being a fat client to a smart client/channel manager, and with the innovative offerings, ATM manufacturers are moving away from hardware-centric models. The recent past witnessed NCR completing a series of acquisitions - Transoft, UGenius, Alaric Systems and Digital Insight. On the other hand, Diebold agreed to buy German rival Wincor Nixdorf. These acquisitions point to the industry's shift towards a software- and services-centric model.

ATMs and branch transformation

The ATM market is also influenced by branch transformation initiatives by banks and is now considered an integral part of the omni-channel strategy. ATMs and other self-service devices play a key role in empowering the reinvented branch, such as deposit automation. New machines deployed by UBS in Switzerland allow people to open bank accounts, and issue brand new debit cards. These new machine can do 95% of what a human teller can do.

ATM innovations

Other technological innovations include:

* Cash recycling, where ATMs accept, validate, sort and store banknotes;

* Speech capability for visually challenged customers;

* Storing consumer preferences as per their past transactions, behaviour, and tailor their services; and

* Cardless ATMs are gaining traction with the big US banks with biometric authentication instead the traditional PIN-based authentication.

ATMs and emerging technological risks

While the technological advancements are innovative and user friendly, they also bring numerous risks and challenges:

* Cardless ATMs increase the vulnerability of data theft;

* The mobile payment methods increase the risk of fraud, as users may lose or misplace their phones;

* The biometric technologies' need for accuracy can prevent easy access for customers; and

* Rising security concerns due to 'Black Box ATM attacks' and ATM 'malware' attacks in both Europe and the US, while ATM skimming still remains a bigger problem in the US.

What the future holds for ATMs

One is reminded of Arnold Schwarzenegger's words from 'The Terminator': "I'm old, not obsolete." The ATMs are evolving, adopting and reinventing themselves to meet the financial services requirements in a digital environment. Notwithstanding the predictions of cash doomsayers, ATMs will, for sure, remain prominent in the retail banking sector.

ATM testing

As a vital touch-point between the financial institutions and customer, ATM testing assumes a greater significance. According to ATM Marketplace Financial, institutions can gain up to 80% in cost and time savings through an effective ATM testing strategy.

Apart from the features and services offered by the ATM, the integration of ATMs with Switch, payment gateways and banking applications need to be thoroughly tested at different levels.

As banks deploy ATMs from different vendors with varying capabilities (standalone, two-in-one and three-in-one), these tests need to be repeated across different machines and multiple vendors. While ATM emulators and simulators reduce the dependency on physical ATM devices for testing to a large extent, certain tests still need to be performed with physical devices.

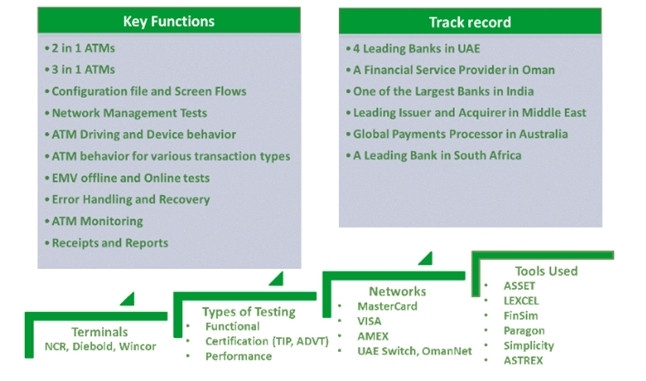

SQS has a proven track record in ATM testing, as you can see below:

[i] Perspectives on Accelerating Global Payment Acceptance, VISA Report, 2016

[ii] http://www.atmmarketplace.com/articles/atmia-2016-the-evolving-future-of-the-atm/

Share

SQS Software Quality Systems

SQS is the world's leading specialist in software quality. It provides end-to-end business process quality assurance for software-based systems. SQS consultants identify and mitigate business risk in technology-led transformations, utilising standardised methodology, industrialised automation solutions, global delivery and deep domain knowledge across multiple industries. Through its specialisation, SQS provides the objectivity which delivers certainty.

Headquartered in Cologne, Germany, the company now employs approximately 4 600 staff. SQS has offices in Germany, the UK, Australia, Egypt, Finland, France, India, Ireland, Italy, Malaysia, the Netherlands, Norway, Austria, Singapore, Sweden, Switzerland, South Africa, the UAE and the US. In addition, SQS maintains a minority stake in a company in Portugal. In 2015, SQS generated revenues of 320.7 million euros.

This position stems from over 30 years of successful consultancy operations. With over 10 000 completed projects under its belt, SQS has a strong client base, including half of the DAX 30, nearly a third of the STOXX 50 and 20% of the FTSE 100 companies.

SQS is the first German company to have a primary listing on AIM, a market operated by the London Stock Exchange. In addition, SQS shares are also traded on the German Stock Exchange in Frankfurt am Main.

Editorial contacts