Investing is all about spotting value where it looks as though there might not be any. Whether it's a traditionally weak economy or market development that others have missed, the best investments are always the ones that others overlook. Although South Africa might not be considered an investment underdog in global terms, the South Africa 40 could be set to offer some unexpected value in the coming months.

According to The Economist's 2017 African Business Outlook Survey, at least nine African countries are set to be among the 20 fastest growing economies in the world by the close of 2017.

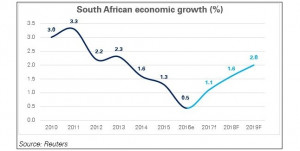

However, in spite of this projected boom in the region, South Africa is currently performing below expectations. Although an expected growth rate of 1.4% is still growth, it's still relatively slow in comparison to the rest of the region's emerging players. Indeed, thanks to internal divisions in the African National Congress as well as regulatory uncertainty in vital areas, South Africa's economy isn't growing at a rapid rate.

Surely this means it's one of the poorer investment opportunities in the region? Not necessarily. As we've said, untapped value is the key to making solid long-term investments and something you can't overlook in this scenery is the fact South Africa is a lynchpin in the region. With companies such as Sappi and Barloworld established in South Africa, the country is essentially a springboard into the rest of Africa.

By this token, companies already on the South Africa 40 essentially have a direct line to some of the world's fastest growing economies. Keen investors will always look for growth potential at micro and macro levels and then try to find a common link between the two. In this instance, South Africa is the key that can unlock the African region and that's why an acute understanding of the South Africa 40 index and its movements is crucial for any investor sizing up the region.

China crisis in SA

Naturally, to understand the growth of many countries in the present day, you have to look at China and its economic output. This is no different in the case of South Africa and this may be one of the reasons investors have become somewhat bearish towards the country in recent years.

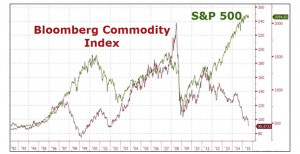

Investors looking for those drivers of growth over the past two decades have looked continually to China. Those investors getting into China early in the right areas, and those realising early the complementary beneficiary areas of China's rapid growth did well. Witness, for example, the rise of the Bloomberg Commodity Index from early in 1999, to the eve of the Financial Crisis of 2008...

This broadly mirrors China's growth in GDP over the same period - until the financial crisis:

http://blogs.ft.com/ftdata/2013/07/15/the-china-slowdown-in-numbers/

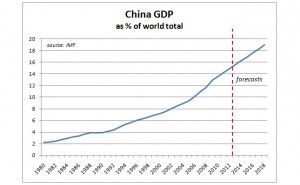

What is interesting to see in this chart is that China's share of world GDP has continued unabated, not even taking a faltering step during the Financial Crisis and consequent commodity price crash.

But investors always look to the future trying to anticipate the market's next big moves and on that score, many investors around the globe became - and remain - fearful of China's slowdown as the planet's main driver of economic growth.

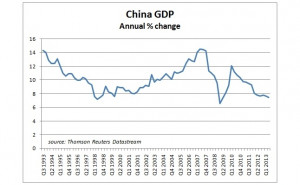

The following chart illustrates the problem:

http://english.cctv.com/2016/12/20/VIDED5k9kgCVR6RgDPPFZI8s161220.shtml

China's slowdown in growth is plain to see - as is the huge impact of the Financial Crisis on that growth. In other words; China's share of global GDP continued to rise at a fairly constant rate - but the country's own GDP dipped broadly in tandem with the rest of the world.

So the years of double-digit per-annum growth would seem to be a memory - and the anticipationof further slowdown is what spooks markets more than the actuality as markets continually look to the future.

Such deceleration in growth has huge implications for most market sectors, but particularly commodities and those economies most dependent on supplying them, which ties in with South Africa's slower than expected growth and the Jim O'Neill's notion of "BRICS". First coined in 2001, BRIC was an acronym used to define the four countries we could expect the world's economic growth to come from, ie, Brazil, Russia, India and China.

Of these four countries over the years that followed, China proved to be, by far, the most significant driver of growth to date. But in 2010, the acronym was changed to incorporate an "S" - and now reads BRICS; a formal designation that now includes S for South Africa. Since 2009, the BRIC or BRICS member countries have met annually at summit meetings. They aim, collectively, to represent the world's emerging economies and to provide something of a counterbalance to the G7 and G20, major global economies' groups, which generally remain dominated by wealthy "first world" economies.

But this growth hasn't actually been forthcoming since South Africa's formal inclusion into the BRICS countries seven years ago as the chart shows...

https://www.sablog.kpmg.co.za/2017/02/pre-budget-economic-outlook/

The South African economy and the South Africa 40

This has largely been due to the slowdown in China and the consequent drop in the commodities index - as South Africa remains largely dependent on commodities as its driver of economic growth due to export markets. However, despite the impact on China and despite regulatory and political issues stunting South Africa's recent growth, it remains a solid investment opportunity thanks to its status within Africa. On top of this, South Africa is one of the most natural resource-rich countries on the planet, with big reserves of coal, platinum, and perhaps most famously of all, gold. Today, when you browse the South Africa 40 index, mining companies such as BHP Billiton, Anglo American, and Gold Fields all occupy to the top 10. In fact, not only do the top 10 South Africa 40 countries account for 70% of the index's overall value, but those with interests in mining dominate this list.

Of course, it's not all about mining when it comes to South African investments, the South Africa 40 and the country's economy overall. Today, finance, real estate and business services contribute more than 20% to the country's GDP compared to mining 5%. In fact, if we take the recent analysis by Alwyn van der Merwe, director of investments at Sanlam Private Investments, companies such as Nedbank and KAP Industrial Holdings are among the top performing businesses in 2016. Essentially, what we're seeing here is a three-pronged reason to invest in South Africa.

In addition to its ever-present strength in the natural resources and commodities markets, we're now seeing sectors such as finance come into their own. Indeed, when you tie this to the fact South Africa will remain a springboard for other companies to launch into Africa as an emerging continent, the positive markers are clear for savvy investors to see. Indeed, at this point, any company on the South Africa 40 should be starting to look as though it's a strong investment opportunity.

Don't get distracted by recent slumps

In your overall assessment of South Africa, it's important not to get too caught up in what was a very severe slowdown in the commodities super-cycle. If you zoom out a little further and look at the country's performance since the lifting of Apartheid, the establishment of democracy and the consequent lifting of sanctions, it's clear to see that South Africa has positively boomed. In fact, between 1996 and 2013, the country's GDP nearly trebled to $400 billion.

The combination of these factors means South Africa is now a growing, steadily maturing and diverse economy, with a growing middle class population, healthy foreign exchange reserves, and, in addition to being a BRICS member, is also the only African nation included in the G-20.

This isn't to underestimate the continued necessity and contribution of the country's rich natural resources, however. South Africa remains one of the most important mining and mineral-processing countries in the world today, despite the aforementioned slow-down. Indeed, home-grown South Africa 40 companies like Gold Fields as well as international players in the market such BHP Billiton still contribute to a mining economy that accounts for over 50% of exports.

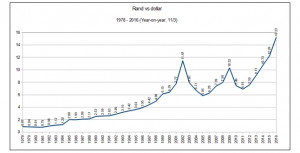

Although this reliance on mining has resulted steady decline in the value of the South African rand against major international currencies over the last four decades - as the rand-dollar chart below illustrates - the market is now in a state of recovery. In fact, according to PwC's 2016 review of the South Africa 40, profitability was restored to the top 40 companies. Thanks to mining companies taking time to refocus and rebuild their businesses after the 2015 crash, the index was able to achieve an aggregate net profit of $20 billion by the close of the year.

https://businesstech.co.za/news/finance/116372/rand-vs-the-dollar-1978-2016/

Is SA still a safe bet for the future?

So, is South Africa now poised for rapid economic growth and does its performance since the commodity price reversal which began in 2008 mean it's also the perfect contrarian play today? Well maybe; if we look at the performance of the South African Johannesburg Stock Exchange (JSE) index over this period, it makes for interesting analysis, but has largely mirrored the performance of other major stock market indices.

Taking a global view of South Africa and its prospects to some extent depends on one's view of the entire global economy and a recovery in demand and, therefore, prices, for commodities. Although China's growth has slowed, it remains a vast market. Yet there has been hardly any recovery in commodity prices since the slump really set in in earnest in mid-2014. Nevertheless, the World Bank forecasts higher prices this year and beyond for all industrial commodities, though mainly energy and metals. If this does come to pass, the South Africa 40 and South Africa as a whole will surely be a big beneficiary - and this could be a good time to make a contrarian bet. But there are plenty of other reasons to see the future as a bright one for savvy, forward-thinking investors in the country.

Beyond South Africa's strength in mining, agriculture could also be a driver of growth. Africa as a continent is under-represented for size on most atlases because of its geographical dynamics. In reality, Africa's 1.2 billion population is almost as large as China (1.3 billion) and India (1.3 billion). In this respect, the arable land potential is huge. Add to this the vast untapped metal, mineral, oil and natural gas reserves in the regions and it's easy to see why the continent is a huge investment opportunity.

However - and this takes us back to our original point - Africa only becomes an accessible investment opportunity for companies, governments and beyond because of South Africa. Thanks to its individual strength and prominence in the region, it's the key that can unlock the rest of the continent to investors. For example, an investment in a South Africa 40 company such as Gold Fields would be more than an investment in the country. As Africa develops and more resources come the fore, companies such as Gold Fields will be the first players into the market. This positioning and potential for profit makes this company and others on the South Africa 40 tantalising investment options.

Even if we look beyond mining-based business, South Africa 40 companies such as Tiger Brands supply packaged foods and other goods to Cameroon, Zimbabwe, Kenya, Mozambique and Nigeria. Again, as Africa as a continent grows in terms of economic strength and countries such as those just listed see a boom in wealth and adapt new consumer behaviors, businesses like Tiger Brands will be become even bigger.

Taking factors such as this into account, analysts and commentators have looked at other specific shares within the South Africa 40 to seek out stocks with what they perceive to be a rosy future - but more cautiously minded investors may prefer a more widespread "basket" approach as a bullish position on the entirety of the country's economy.

Based on this, the South Africa 40 looks to be a logical place to start for those investors wishing to gain some exposure to the country as part of an overall balanced and diverse portfolio - without putting all their eggs in the one proverbial basket. Of course, no-one ever really knows what the future holds. However, one thing that does look certain is that sub-Saharan Africa will see enormous economic changes over the next 10 or 20 years and South Africa will play an integral role in shaping the economic future of the whole region.

Share