Finance Minister Pravin Gordhan delivered his Budget Speech on 26 February, favouring consistency and steadiness over change and fireworks, ahead of the national election on 7 May.

Some tax relief for tax payers in the 2014/15 Budget Speech - 40% of the tax relief was allocated to those who earn up to R250 000 per annum, meaning individuals earning more than R250 000 per annum will receive a little less of the allocated tax relief pool.

Though some commentators had speculated that high earners would need to pay higher income tax, the minister left income tax rates untouched, says Madelein van der Watt, Development Manager at Sage Pastel Payroll & HR. The lowest tax bracket remains at a tax rate of 18% (annual taxable income up to R174 550) and the highest tax bracket remains taxable at 40% (annual taxable income of more than R673 100).

Tax credits for medical scheme contributions

Effective from 1 March 2012, the medical aid capping system was replaced with a tax credit - bringing in equality for all taxpayers under the age of 65 and improved benefits for lower earners.

In the new tax year, commencing 1 March 2014, monthly tax credits for medical scheme contributions (reduction of tax payable) have been marginally increased from:

* R242 to R257 for the main member and the first dependent on a medical scheme.

* R162 to R172 for each additional beneficiary on the medical scheme.

The medical aid tax credit system allows a reduction on income tax and does not reduce taxable earnings as the medical aid deduction system allowed in the past.

"The credit system is a more fair approach to providing tax relief, as each individual contributing towards a medical aid fund will receive equal relief as it is not based on annual earnings. Whether an individual earns R250 000 per annum or R2 500 000 per annum, the income tax liability will be reduced by R257 for each of these individuals, with at least a single beneficiary on the medical aid fund."

From the 2014/15 tax year, medical aid contributions by people older than 65 will also be subject to the medical aid tax credit system. Up until now, those contributions were fully tax deductible. Effective from 1 March 2014, their contributions will also be subject to the medical aid tax credit system.

Is it a fringe benefit?

The company contribution towards an employee's medical aid yields a taxable fringe benefit.

Generally, any payment made by an employer on an employee's behalf, must be included in an individual's taxable remuneration, before calculating the final PAYE deduction. Only pension and provident fund contributions are still exempt from the rule until 1 March 2015.

Regardless of an employee's age or employment contract conditions, the medical aid contributed by an employer, whether in cash or as a package component directly to the fund, must be treated as a taxable fringe benefit.

The contribution paid by the employer will be subject to employee's tax, and contrary to popular belief, there is no way to structure a salary package to bypass the fringe benefit.

During the 2012/13 year of assessment, 76% of all fringe benefits reported on tax certificates were medical aid contributions made by employers on behalf of their employees.

Medical aid contributions must be reported on the employee's tax certificate

As part of the employer filing season, each company is responsible to issue their respective employees with a tax certificate.

Medical aid contributions, both the employee and employer contributions, must reflect on the employees' tax certificates (IRP5/IT3A). If you're making use of an automated payroll system, the codes are already loaded for you. In addition, if a company is making use of an automated payroll system, it can import a payroll file with all the filing requirements directly into the e@syFile Employer system and the payroll EMP501 Reconciliation Report to complete the PAYE, SDL and UIF reconciliations. Van der Watt points out this saves businesses considerable time and cost compared to manual calculation and capturing.

If you're making use of a manual payroll system or payroll spreadsheets, please make use of the following codes:

* Source code 4005 for employee and employer contributions;

* Source code 3810 for the taxable fringe benefit equivalent of the employer's contribution; and

* Source code 4116 for tax credits allowed.

How can an automated payroll system make your business life easier?

To calculate the correct employee's tax effect of a medical aid contribution, an employer must take the following into account:

1. What is the total contribution that must be processed every month?

2. How much of the contribution must be deducted from the employee's gross income and how much is payable by the employer?

3. Is the employer's payment made as a cash contribution to the employee or paid directly to the medical aid?

4. Remember to include any employer payment as a taxable fringe benefit when calculating the PAYE deduction for the month.

5. How many dependents belong to the employee's medical aid?

6. Remember to constantly keep track of new dependents added or dependents removed from the medical aid policy.

7. Remember to check for any contribution increases or change in medical aid cover that might affect the contribution value processed on the payroll.

8. Don't forget to calculate the medical aid tax credit after you have determined PAYE based on taxable earnings. The tax credit is based on the number of dependents and must reduce the PAYE value before you calculate the net pay.

9. Every six months, you need to submit a PAYE reconciliation to SARS detailing the contributions, fringe benefits and tax credits related to medical aid contributions.

Payroll software will take care of the calculations and reporting of medical aid contributions and the PAYE effect thereof.

It is also important to keep in mind that effective 1 March 2014, employees aged 65 and older are also included in the medical aid tax credit system and their contributions may no longer be allowed as tax deductions. If you still make use of spreadsheet or manual methods of calculating PAYE, it is important to adjust your calculations to not only cater for new medical aid tax credits for the 2014/15 tax year, but also to keep in mind that you need to adjust the calculation for your employees aged 65 and older.

"Our software is designed to make your business life so much easier, so that you can focus on running your business. Let automated payroll solutions take care of the six major payroll acts and the ever-changing legislative plethora that governs payroll," says Sumay Dippenaar, Marketing Manager at Sage Pastel Payroll & HR.

"There is no reason for businesses to rely on manual payroll spreadsheets since we offer automated solutions that are easy-to-use, smart and affordable, whether you deploy them on the desktop or in the cloud. Our subscription-based payroll solution allows you to pay low monthly fees with no upfront capital outlay, keeping your cash flow in mind." With an online payroll solution, you only pay per payslip that you process. This pay-as-you-go model is cost-effective, at R18 excluding VAT per payslip.

Example

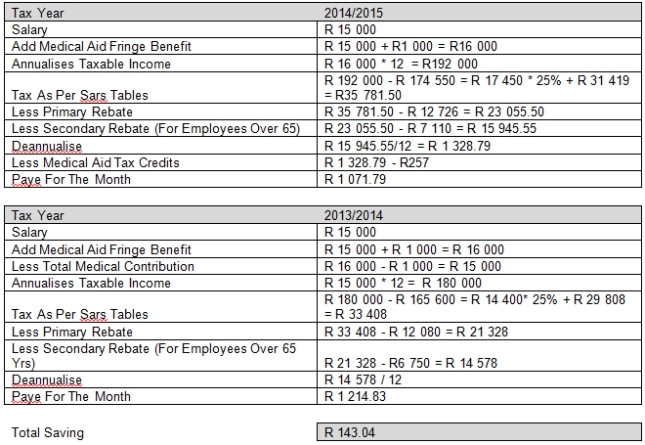

Jim Hardens is 67 years old, he earns a basic salary of R15 000 per month and the company contributes the full medical aid contribution of R1 000 on his behalf. He is the only member on his medical aid.

Below, please see how the calculation differs for tax year 2013/14 and 2014/15. Seeing that Hardens is over 65 years, he also needs to be taxed on the medical tax credit system, effective 1 March 2014. Hardens will enjoy a tax saving of R143.04 in the new tax year.

Nifty quick links and tools

* FREE Salary Tax Calculator

* FREE Online Logbook

* FREE Tax Guide

* Attend a Budget Speech Seminar, everything explained in laymen's terms

* New Tax Rates

* Everything else you need to know

* Automate your payroll using an online solution

For the latest legislative news, connect with Sage Pastel Payroll & HR on Twitter (Payroll News), Facebook or LinkedIn. To read more about the upcoming budget speech, click here.

Share

Sage Pastel Payroll & HR

Sage Pastel Payroll & HR, part of Sage South Africa, is a leading developer of payroll and HR software solutions and services. Sage Pastel Payroll & HR provides a wide range of software solutions from start-up to medium-sized businesses, giving you more time to do the things you want to - grow your business. We offer easy-to-use, efficient and secure payroll and HR software solutions to ensure businesses are kept up to date and fully compliant with ever changing legislative requirements. From the intuitive design of our software to the expertise of our people, we focus on giving businesses the confidence and control they need to achieve their business ambition.

Established 25 years ago, Sage Pastel provides small businesses with a complete, integrated solution to their financial software needs through the Sage Pastel Accounting and Sage Pastel Payroll & HR solutions.

www.pastelpayroll.co.za

www.pastelmypayroll.co.za

www.sagepastelonline.com

Sage

Sage provides small and medium-sized organisations with a range of easy-to-use, secure and efficient business management software and services - from accounting and payroll, to enterprise resource planning, customer relationship management and payments. Sage customers receive continuous advice and support through its global network of local experts to help them solve their business problems, giving them the confidence to achieve their business ambitions. Formed in 1981, Sage was floated on the London Stock Exchange in 1989 and entered the FTSE 100 in 1999. Sage has over 6 million customers and more than 12 700 employees in 24 countries covering the UK and Ireland, mainland Europe, North America, South Africa, Australia, Asia and Brazil. For further information, please visit www.sage.com.

Editorial contacts