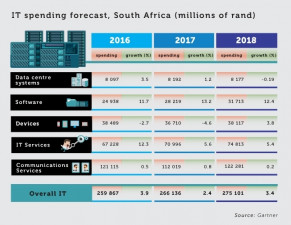

IT spending in SA is forecast to total R266 billion in 2017, a 2.4% increase from 2016.

This is according to market analyst firm Gartner, which says software is predicted to be the best-performing segment, with a 13.2% increase year-on-year.

In a telephonic interview with ITWeb yesterday, John-David Lovelock, vice-president and distinguished analyst at Gartner, said the biggest driver of growth in IT spending is the software segment, particularly the enterprise software segment.

"For example, we are witnessing huge spending in customer relationship management, supply chain management and enterprise resource planning software - the kind of software that runs and builds a business."

He added there is also strong growth in analytics and business intelligence, content management software as well as business collaboration tools.

"So, across the board, South Africa is beginning to invest heavily in its software. It's able to do that because it now has better-run data centres and most organisations have opportunities to move to the cloud."

According to Lovelock, SA has traditionally underinvested in IT. "There is a time for every country to make some investments in IT. When you look at a country's GDP, as well as its productivity index, it can give you a good idea of how much that country should be spending on IT."

In this case, he points out that in the past SA was below where Gartner expected it to be. "But in the past few years, South Africa has come up to where we expect it to be in regards to IT spending."

There was a time when the infrastructure in the country was not supporting IT spending, he pointed out, noting these problems have, however, been overcome in the past five years.

"South Africa's IT spending is now where we expect it to be but it is still to surpass our expectations although it's on the path to do so. This year, we expected it to spend R270 billion, so there is a very small shortfall in our expectations and what the country is spending this year.

"South African organisations continue to prioritise investments in software, as software spending is the means by which they will catch up with the rest of the world."

Nonetheless, Gartner says spending on devices (PCs, tablets, ultramobiles and mobile phones) in SA is forecast to decline by 4.6% in 2017. It notes that purchases of devices by businesses and consumers are slowing in the face of rising prices and in the expectation of new products.

"However, 2018 is set to be a rebound year," says Lovelock. "The introduction of premium smartphones will increase device spending by 3.8% in that year."

The analyst firm points out that spending on communications services, the largest segment in SA, reached R122 billion in 2017, a 0.8% rise. "Price competition between regional carriers, along with extremely price-sensitive consumers, is preventing substantial growth in spending in this segment, despite an overall increase in mobile device ownership," says Lovelock.

He believes currency fluctuations against the US dollar can have a deleterious effect on IT spending in SA. The cost of most IT products is based in dollars, which means local prices in rand must increase enough to cover costs and margins in dollars, says Gartner, adding the higher the dollar cost of a product or service, the more volatile the local price is to currency movements.

"Despite a dip against the dollar in the last few weeks, the rand strength against the dollar has been up in 2016 and this will help curb the recent price increases seen on servers, storage and devices," Lovelock adds.

"South African organisations should learn from their European counterparts. They should embed currency risk into all IT contracts, ensure long-term contracts are priced in rand, and seek local delivery, where possible."

Gartner's IT spending forecast methodology relies heavily on rigorous analysis of sales by thousands of vendors across the entire range of IT products and services. It uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data on which to base its forecasts.

Share