The ever-increasing growth in terrestrial fibre networks, both international submarine cables as well as national and metropolitan networks, has created an expectation that fibre networks and fibre connectivity will soon be the default option for broadband and IP access services in South Africa and Africa.

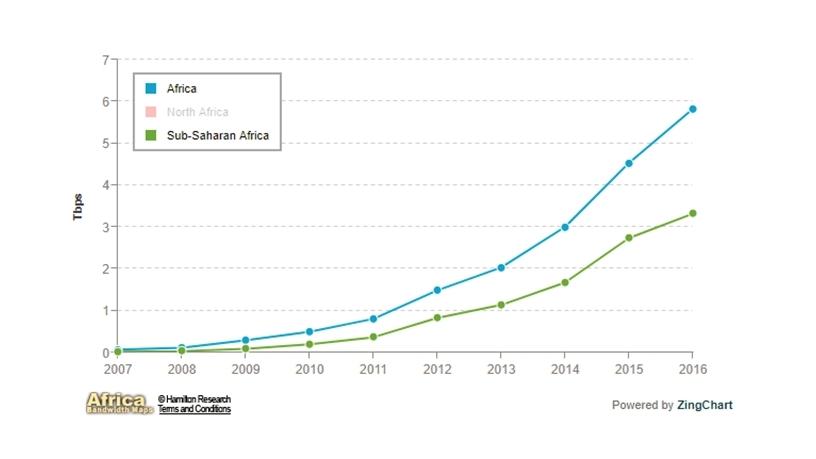

International capacity

When considering that Africa reached almost 6Tbps of international access bandwidth at the start of 2017, which is close to a 30% increase from the 4,5Tbps in 2015, the growth is indeed exponential (refer Hamilton Research, Africa Telecom Transmission Map). From this perspective, it is understandable that fibre networks are becoming the preferred technology to provide primary international trunk services in a point-to-point service delivery configuration.

Terrestrial fibre network growth

The latest Africa Telecom Transmission Map provides a view of the strong growth of terrestrial fibre networks exceeding 1 million route-km in 2015. In 2014, it was 958 901-km and in 2013 it was 905 259-km, indicating a strong year-on-year growth that is expected to continue in the near future.

It is estimated that about one fifth of this network is in cities, connecting business and residential consumers at speeds up to 100Mbps.

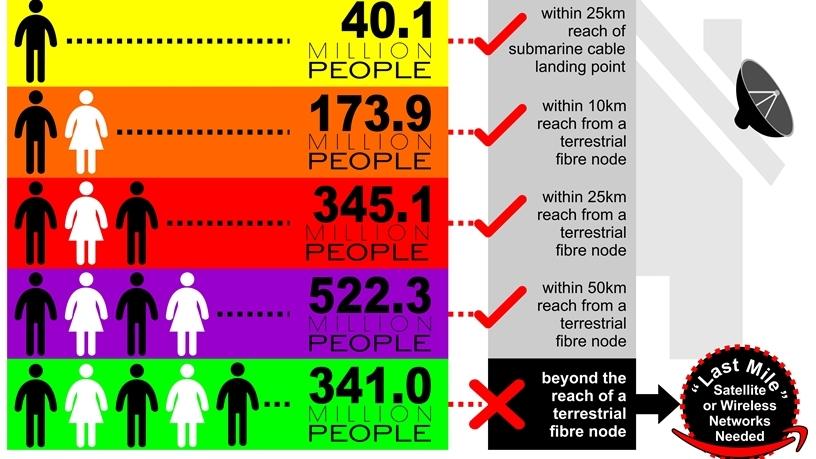

Population reach

In 2015, the African fibre network expansion has brought more than 176 million people access to high capacity services. In June 2015, 45,8% of the population was within 25km range, and 341 million people were beyond the reach of terrestrial fibre nodes.

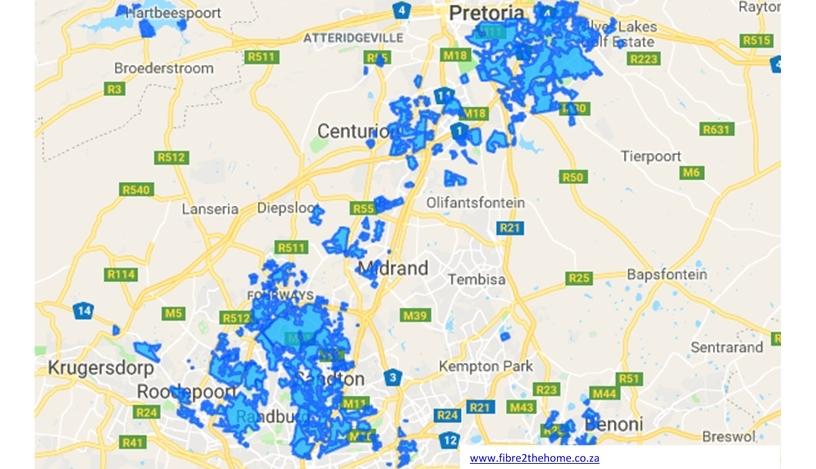

South Africa scenario

Putting the reach of the African terrestrial fibre networks in context, the situation for the wider Gauteng area is provided by a composite map, compliments of Otel.

This shows the positive growth of fibre networks as well as showing the fast-open areas not connected.

While it can be expected that the networks will grow, it should be remembered that a fibre network investment must be recovered from the subscribers in a particular area.

This will drive the requirement that fibre networks can only be deployed for residential and business areas where the demand and subscriber uptake will balance the network investment.

So why satellite networks?

With only 48% of the African population now serviced, it leaves more than half of the population without any connectivity. Adding to this the fact that the fibre business case requires high subscriber densities, it can be expected that as much as a 30% of Africa's population will be outside the feasible reach of fibre networks.

Within this context, it is clear why the satellite industry has continued to develop and grow in order to be an alternative connectivity medium. It is expected that fibre will always be the preferred option, it will just not be available always and everywhere.

As a specialist "off-grid" solutions and services telco, Q-KON focuses on developing and servicing government, business and consumers who are "off-grid" and not within reach of the national terrestrial telco networks. Together with world-leading international partners, we are developing the services which will continue to meet the performance and cost demands for this specialist market sector.

It is Q-KON view that the question is not "When will fibre replace satellite?" it is rather a matter of understanding the constraints and limitations of both technologies and enabling the market accordingly.

Share

Editorial contacts