Jitters over a possible fallout in the Korean Peninsula, over North Korea's development of nuclear technology, has raised concerns that key PC, smartphone and tablet components could suddenly disappear from the market.

This could have a ripple effect on SA, leading to higher technology prices.

South Korea accounts for 50% of global production for dynamic random access memory (DRAM), two-thirds of NAND flash manufacturing, and 70% of the world's tablet display supply. However, neighbouring North Korea has been developing nuclear technology, raising the ire of the US and leading to fears of a nuclear war.

Although research firm IHS does not see a major battle as likely, technology companies are planning ahead to stave off a global disruption. Locally, suppliers would run out of components in about three months in the worst-case scenario.

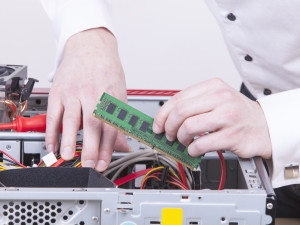

DRAM plays an essential role in products including PCs, media tablets and smartphones, says IHS. It adds that the large-sized display market is heavily dependent on South Korean suppliers, especially in the media tablet market.

Limited supply

AxizWorkgroup executive for software and enterprise, Craig Brunsden, says SA would also be "dramatically" affected along with other countries, leading to higher prices.

Brunsden says the only buffer in the event of real disaster in South Korea would be existing inventories in channels across the world. "After that, as SA can only source product from abroad and as South Korea is such a big producer of base components, the situation could be a very serious supply shortage."

There would be price increases, says Brunsden. He points out that the effect would be similar to the one seen from around 2011 when several hard drive manufacturers were under water in Japan after a flood, leading to supply disruptions and prices rising about 70%.

Brunsden says, as South Korean manufacturing is so important to the supply globally, world powers are likely to do all they can to avoid the scenario. He notes there is not enough stock to survive extended supply disruptions, especially not on a global scale.

Balance could be restored quickly, says Brunsden, although this depends on the nature of disruptions. "If facilities were damaged, like in Japan, that could take months to be restored."

Spill over

Brunsden says DRAM and NAND pricing fluctuates daily, so the effect would be quick. "Most major manufacturers have purchase price agreements so this could help, depending on whether they are enforceable or not. If not, the ramifications could be [seen] within days."

NAND flash is typically used for memory cards, USB flash drives, solid-state drives, and similar products, for general storage and transfer of data, explains Wikipedia. DRAM is used in laptops and desktops.

An increase in pricing is likely to be passed onto consumers, says Brunsden. "The degree and speed would depend on the nature of the supply side increase, and how big and quickly it is passed into the supply chain."

Brunsden explains manufacturer and channel margins are not big enough to absorb any large price shocks for periods of time.

Although it is difficult to quantify stock levels across the industry, Brunsden estimates there is less than a quarter's worth of sales. He adds that if production is disrupted for a long period of time, there is a possibility SA could run out of the components. "It really depends on what factories and devices are most affected and to what degree."

Heavily reliant

IHS says if half of all global production for DRAM, two-thirds of NAND flash manufacturing, and 70% of the world's tablet display supply suddenly disappeared from the market, there would be chaos.

The global electronics supply chain would grind to a halt and stop major market product segments in their tracks, including smartphones, media tablets and PCs, says the research firm.

IHS says, although such a major conflagration and disruption is unlikely, forward-thinking technology firms are planning for such a contingency, just as they are preparing for other natural and man-made disasters that could impact their businesses in the future.

"South Korea now plays a more important role than ever in the global electronics business. And with the supply chain having become more entwined and connected, a significant disruption in any region will impact the entire world," says Mike Howard, senior principal analyst for DRAM and memory at IHS. He says companies should make contingency plans.

"Any type of manufacturing disruption of six months would prevent the shipment of hundreds of millions of mobile phones, and tens of millions of PCs and media tablets," Howard warns. "Such a high proportion of global production could not be easily or quickly replaced by manufacturers in other regions."

However, James Scott, Tarsus Technologies executive director, points out that if the dispute escalated into a nuclear battle, computer components would be the least of the world's problems.

Share