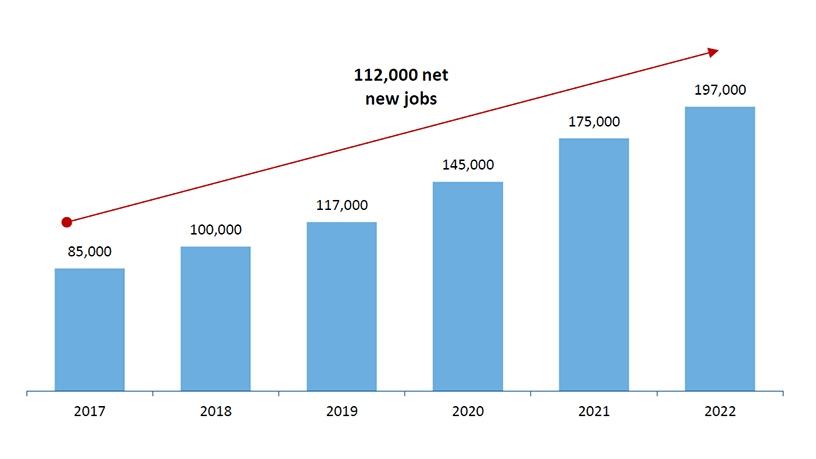

The adoption of cloud services will generate nearly 112 000 new jobs in SA by 2022.

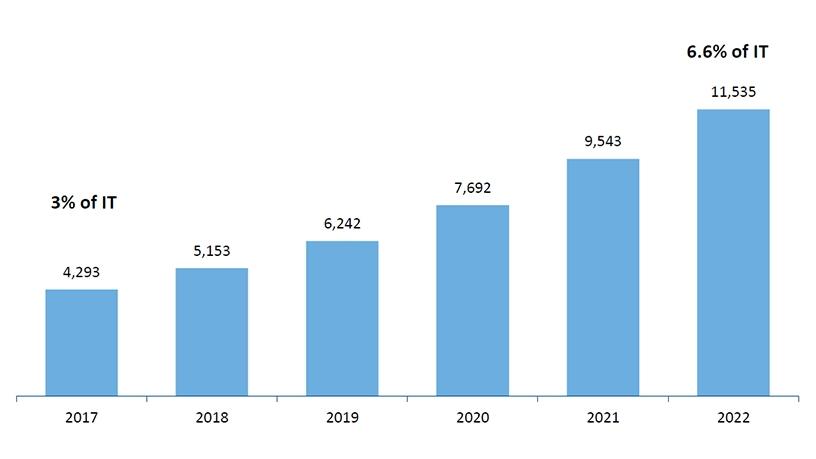

This is according to a new report from data analytics firm IDC, which predicts spending on public cloud services will nearly triple over the next five years, up from R4.29 billion in 2017 to R11.53 billion in 2022.

The report, "Economic Impact of IT and Microsoft in South Africa", was commissioned by Microsoft and carried out by IDC.

According to Mark Walker, associate VP for Sub-Saharan Africa at IDC, the economic impact model shows that spend on cloud is one of the fast-growing technology segments in SA, with a compound annual growth rate (CAGR) of 21.9% expected through 2022.

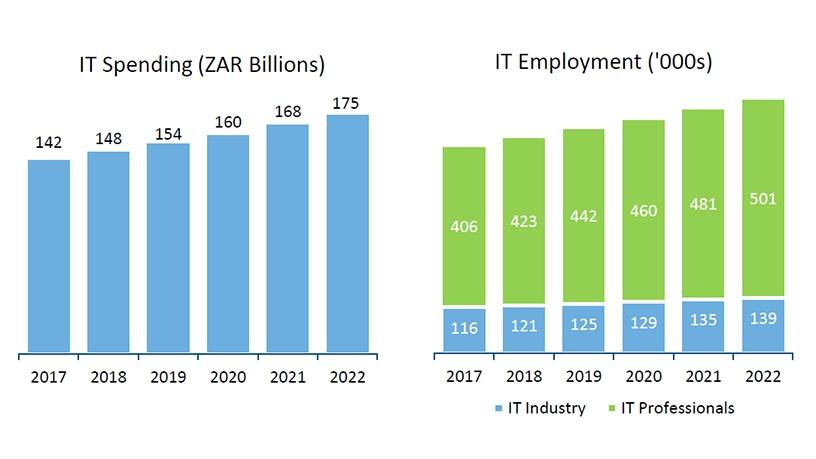

The study also found the overall IT sector in SA is expected to create as much as 119 000 net new jobs over the course of the next five years. Additionally, the IT sector in SA is expected to grow at a five-year CAGR of 4.25%, to reach R175 billion by 2022, by which time IT employment will have surpassed 640 000.

The report discusses the impact IT, cloud services and the Microsoft ecosystem will have on the South African economy between year-end 2017 and year-end 2022. The document builds on more than a decade of IDC analyses concerning the economic impact of IT on local economies.

In 2017, the political environment in SA was uncertain and the rand was weak against the US dollar; nevertheless, the IT sector continued to play a significant role in the South African economy. SA is the largest IT market in Africa and accounts for nearly 30% of overall IT spending on the continent.

IDC believes that as SA enters a period of moderate economic recovery, IT will play a critical role in the transformation of the economy as a whole, supporting smart city initiatives and propelling the rise of "digital businesses" across sectors.

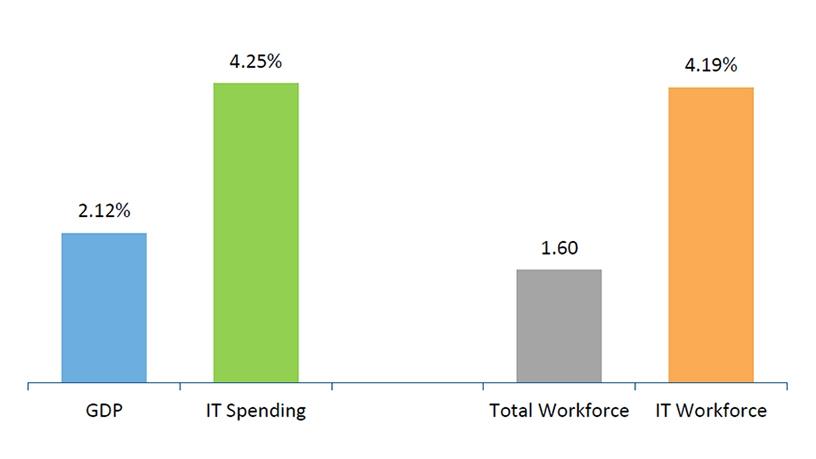

Walker says IT spend in SA increased by over 4.2% in 2017, compared to GDP growth of around 1.5%.

The local IT market is forecast to grow twice as fast as GDP over 2017-2022; also over the next five years, the growth rate of the IT workforce in SA will be almost threefold that of the total workforce.

In 2017, IT accounted for nearly 3.1% of South African GDP and the IT workforce of 522 000 corresponded to 3.3% of the total workforce in the country. However, by 2022, IT jobs will grow to represent almost 4% of the total workforce.

"IT spend is growing faster than SA's economy, IT jobs are growing faster than overall national jobs, and within IT jobs, IT professionals, the people that make technology, are growing faster than those that just use technology," Walker says.

"What comes out very clearly for me from the report is the acceleration that is taking place, if you look at the next five years and the growth we are seeing. My own view is it will be a little bit faster than the IDC predictions," adds Zoaib Hoosen, MD of Microsoft SA.

The acceleration and pace of this digital transformation opportunity will be entrenched in the country, as companies start to find ways of reinventing their products, services and business models, and using technology like cloud, big data analytics, the Internet of things, machine learning and of course AI, he says.

The cloud factor

According to the report, the increased utilisation of public cloud services and the additional investments in private and hybrid cloud solutions will enable local organisations to focus on innovation and accelerate the pace of digital business transformation. In turn, this enablement will help businesses generate close to R81 billion in new revenue over the next five years.

Public cloud services accounted for 3% of overall IT spending in SA in 2017. In 2022, IDC expects public cloud services to account for 6.6% of overall IT spending.

"This increase in adoption will primarily be driven by migration of new and existing workloads to public cloud. The improved availability of public cloud services, due to rising investments by international vendors and local services providers, will also contribute to the increased uptake," the report says.

While public cloud services accounted for a small portion of IT spending in 2017, the rise in innovation and the greater use of both public and private cloud services will lead to increased business revenue in SA, as well as create new jobs.

Microsoft impact

IDC believes that by 2022, the Microsoft ecosystem could add 53 000 net new jobs to the South African economy.

In 2017, IDC found that nearly 60% of all software purchased in SA ran on a Microsoft operating system, as did 85% of the PCs and nearly 67% of servers purchased during the year.

The Microsoft ecosystem, which includes hardware, software, services and distribution (channel partners), brought in nearly R60 billion in 2017 and invested nearly R23 billion in training, research and development, product development and testing, and marketing and sales during the year, IDC says.

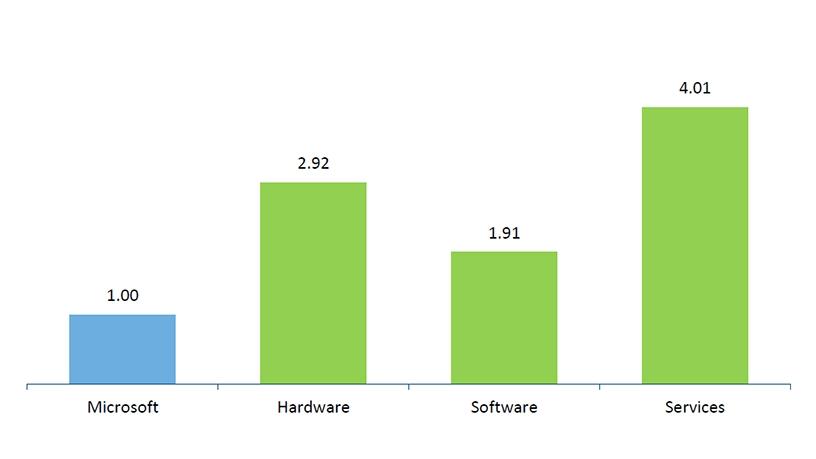

The value of hardware and software running on Microsoft software and services far outweighed Microsoft's own revenue. The ecosystem itself is far bigger than Microsoft, accounting for downstream revenue of R8.84 for every rand that Microsoft generates (R2.92 on hardware, R1.91 on software and R4.01 on services).

If the Microsoft ecosystem's share of IT spending in SA remains steady through 2022, IDC expects more than 53 000 net new jobs to be created in the IT sector.

*Graphics Source: IDC, 2018

Share