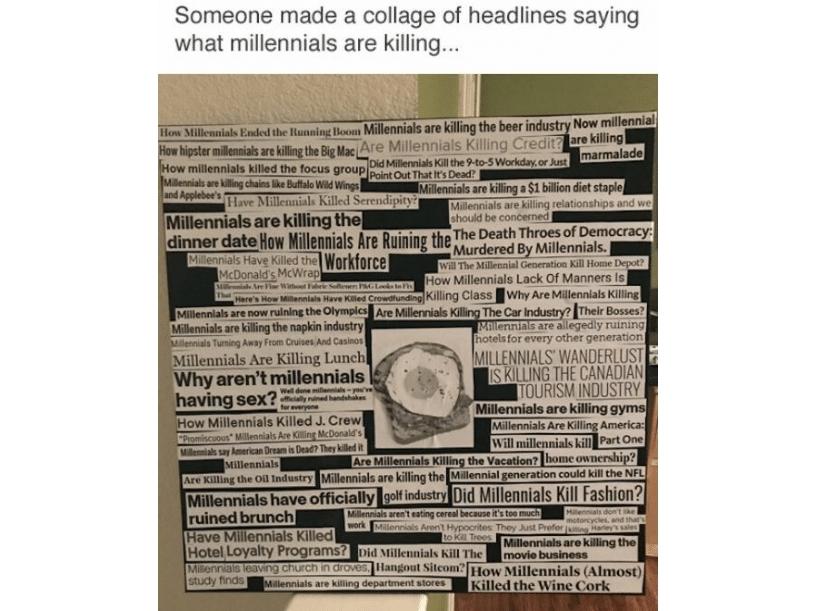

Climate change and war ain't got nothing on millennials. At least, that's if you believe the clickbait.

Has any other force in history been responsible for this much destruction? Millennials have been blamed for the death of so many brands, industries and ways of living that it's become a running joke on social media.

Get your information on millennials from the Internet and you'll come away with a very cartoonish picture of them. They're not interested in getting married. They're moochers. They can't afford home ownership because they eat too many avocados.

Stereotyping millennials has become its own industry, and it's time to put a stop to it. It's tired, it's inaccurate and, most of all, it's poor business strategy.

The oldest millennials are in their mid-30s and have been contributing members of society and the workplace for years. Why do people persist in treating them like rebellious teenagers when many of them are old enough to have teenagers of their own?

South African businesses, especially, seem to be stuck in this pattern of treating millennials like some scary new trend or alien presence, rather than established consumers with their own documented buying patterns and behaviours. This, despite the fact that millennials make up 27% of the South African population.

As we celebrate Youth Month, it's time to take a data-driven look at the generation that people can't seem to stop making stuff up about.

Not so different after all

By this point, everyone has a picture of typical millennials. They're digital-first consumers who value authenticity and flexibility and aren't afraid to make their opinions heard. They're collaborative and want to be involved, whether it's taking ownership of a brand or solving challenges in the workplace.

But, what does the data tell us about the ways they differ? Just how different are they from other generations? Do the numbers back up the claims that they have poorer life skills or radically different priorities?

According to TransUnion's studies on millennials, they're not all that dissimilar when it comes to priorities in life, only in how they're able to access them. They're undeniably interested in home ownership: 75% plan on purchasing a home in the future, but have more trouble accessing credit thanks to difficult labour markets.

With less disposable income to work with, many millennials tend to pay their bills at a slower rate than other generations, but show an overwhelming will to settle their debts if they have the means. In many ways, they show more responsible financial behaviour, preferring debit to credit cards.

And the perception that millennials are more mercenary than other generations? It turns out they're just as likely to show strong loyalty under the right circumstances, particularly towards brands that solicit and reward their fidelity.

The more you look at the data, the less weight the negative stereotypes have. Millennials make for excellent consumers, provided you're able to tailor your service and delivery models to their needs.

Portrait of a South African millennial

The other danger of trusting in clickbait for your impression of millennials is those articles are focused heavily on the US. In SA, while many of the broader tendencies are similar (digitally savvy, ambitious, prefer things on their own terms), our history means our millennials show more financial mobility than their American peers.

Why do people persist in treating them like rebellious teenagers?

TransUnion data reveals that, while their US counterparts aren't inclined towards cards, South African millennials are the largest cardholder group in the country. They have the highest participation across all generations in vehicle finance and personal loan products. According to a recent Old Mutual report, they're also more likely to invest in formal saving products than their parents.

South African millennials also buck stereotypes when it comes to repaying bank cards, vehicle finance and mortgages, where they perform nearly the same as the older Gen X group. There's one glaring exception, though. Their delinquency rates are higher when taking out personal loans.

To throw yet another spanner in the works, there's a clear behavioural differentiation between older (aged 30 and up) and younger (23-29) millennials. The 20-something crowd is significantly behind the older segment in overall credit activity, and more likely to be thin-file consumers who could benefit from alternative data models.

As much as we try to generalise their behaviour, there's no one universal millennial experience that can be summed up by a catchy headline or single study, especially in SA. It's time to stop using millennials as shorthand, stereotype or scapegoat, and instead treat this diverse, technologically savvy group as an opportunity to improve how you engage with people. By being proactive in identifying customer needs, triggers and risks, businesses can, and should, design more flexible products and repayment structures, as well as accessible financial education.

In an age of hyper-personalisation and individualisation, no organisation can afford to view any audience as a monolith.

If your business is failing to adapt your product offerings to a segment of the population 14 million strong, that's on your shoulders, not theirs.

Are you using business intelligence to truly get to know your customers or employees, or are you falling back on easy assumptions? What do you think businesses keep getting wrong about reaching so-called millennials?

Share