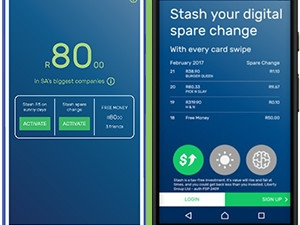

Investment group Liberty has created an app which lets users easily save and invest 'spare change' from everyday purchases.

Every transaction made by the user is rounded up to the nearest R10 and the surplus is stored in a tax-free savings account. Liberty says it was created to address the poor savings culture in SA.

The app, called Stash, was designed to be easy to set up, without the need to fill out forms or talk to a financial advisor.

"When it comes to investing, getting started is the hardest part. I can remember the homework I had to do to make sense of where I was putting my money. It seemed like too much work and I kept putting it off. Investing should be as easy as tweeting - that's the goal of Stash," says Juan Labuschagne, head of development.

He says it takes the average user 49 seconds to set up their Stash - from start to finish. Liberty also gives users R50 upfront to kick-start their savings, and will give a further R10 each time the user refers a friend.

Users decide how much they want to stash. The app rounds up the amount of every transaction. If a user decides on a Stash limit per transaction of R10, and the user makes a transaction for R45, this would be rounded up to R50. The R5 in change is stashed.

"All this spare change accumulates without interfering with your day-to-day life. Stash checks your daily bank balance and never transfers more than you can afford, so you don't have to worry about going into overdraft," says Labuschagne.

Any South African bank, except Capitec, can be linked to Stash.

The money in Stash goes into a tax-free savings account and is invested in SA's top 100 listed companies. Under a ruling made by the South African government in 2015, R33 000 a year can be saved in these accounts, and up to R500 000 over a lifetime.

This applies to all tax-free savings accounts, so if users have a separate tax-free account, they will have to note its balance before signing up for Stash, as going over R33 000 could result in fines.

Owners of these accounts are not taxed on the growth of this money, are not penalised when they cash out, and they can put in or withdraw money whenever they like.

The app is only available to Android users at the moment, with an iOS version in the pipeline. It can be downloaded for free from the Google Play Store.

Share