Local secure cash management firm Cash Connect has unveiled a self-service bulk deposit acceptor machine, specifically for the retail distribution industry (larger businesses) who for example deliver consumer goods.

The bulk deposit ATM (BDA), which is similar to an ATM, allows bulk note and coin deposits to be processed simultaneously. Cash Connect CEO Richard Phillips says the machine is able to take a deposit of 800 notes and 800 coins per minute. "The machine, which is possibly a first for South Africa, has proven to be very efficient, at least four to six times faster than a manual counting and verification process. Automated cash management eliminates the need for manual paperwork and reconciliations, and drastically reduces incidences of human error," he said.

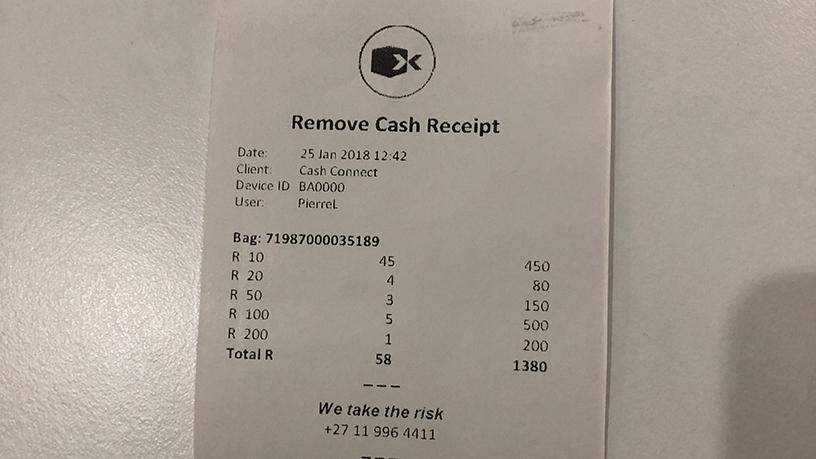

Pierre Liebenberg, general manager for solutions development and manufacturing at Cash Connect, explains that technology behind the BDA includes a biometric identification system that every depositor needs to register on. "The system reinforces accountability and eliminates cash shrinkage. Retailers' cash is guaranteed through a system that identifies people and assigns accountability based on fingerprints," he said, "following a successful deposit - the depositor is presented with a deposit slip and the money is dropped into a cash vault built to SABS Category 4 standards. Simultaneously all deposits are saved in the cloud where the financial manager is able to have access to an online portal that shows their deposits, recons and transaction history as well as be able to download financial reports."

Liebenberg adds that once the money is safely dropped in the vault, it is heat sealed in a disposable barcoded bag, "The very barcode allows the financial manager to monitor and track the cash as cash in transit personnel remove it from the vault to the bank."

All software on the BDA is locally developed at the company's Durban plant, he said.

Job losses

The debate of how hi-tech advancements and automation in industries is resulting in job losses has been on high rotation recently. This week - a PwC Global CEO Survey - released at the World Economic Forum in Davos - indicated that 41% of CEOs in SA expect to reduce their headcount in the next year. Two-thirds of the executive leaders expressed this is mainly due to automation and other technologies.

"Although the machine has a touch screen for self-service deposits, it will not be replacing the cashiers in their entirety. It will enable a speedy reconciliation, bank deposit and verification process for them and furthermore we are able to provide on-site technical training to operators who will from time to time need to man the machine," explained Phillips.

Liebenberg adds that personnel will also be taught to deal with interferences that may need human intervention such as releasing a jammed note in the machine.

Pierre Liebenberg, general manager for solutions development and manufacturing at Cash Connect demonstrating the BDA functionality.

Share