While the advent of mobile money in other African countries has proven it is both lucrative and valuable to society, it remains a largely untapped market in SA, due to the proprietary mind-set of the parties involved.

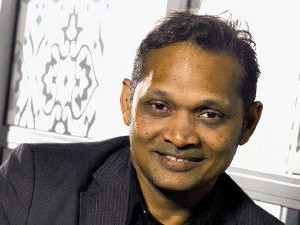

This is according to managing executive for mobile commerce at Vodacom, Herman Singh, former head of Standard Bank's Beyond Payments division and the man recently tasked with the resurrection of the cellphone network's financial services platform.

Local industry players have for some time been looking to other models and means for mobile money transfer solutions, amid the failure of these to take off in SA, with industry observers identifying key areas in which they have been barking up the wrong tree.

World Wide Worx MD Arthur Goldstuck, who has done extensive research into the local m-commerce market, has identified the failure to treat all markets as different - and SA as unique in its own right - in every way, including culturally, financially, socially and politically.

Singh says SA is a unique amalgam in that the country has sophisticated first-world banking infrastructure on the one hand - with banking apps, smart ATMs and sophisticated wallets - and a huge market that doesn't use these services on the other.

"SA is a combination of Egypt and Switzerland. Despite the money transfer capabilities we have, unfortunately due to access and cost, these exclude a large part of the market." An estimated 13 million people in SA are either unbanked, under-banked or unhappily banked, he says.

Local loop

Singh attributes this scenario to the fact that SA is typified by "proprietary closed-loop systems", in that all mobile wallets are closed.

"There is this attempt by parties to own the market and that is not how payment systems evolve. How they evolve is by building an ecosystem made up of key players - which for a long time have consisted of banks and retailers - but over the past 10 to 15 years this has come to include telcos."

Despite the money transfer capabilities we have, unfortunately due to access and cost, these exclude a large part of the market, says Vodacom's managing executive for mobile commerce Herman Singh.

And telcos, says Singh, are in a prime position to play a useful role in SA's m-commerce development, considering they can operate in the last mile.

"The last mile is the distance from an individual's house to the local shop - which in SA is 300m. The problem is, if you can't get to a branch or an ATM and the wallet on your phone has limited capabilities in terms of working across different banks and retailers, you can't access the service."

Crawl, walk, run

He says the time has come for all three players - banks, telcos and retailers - to start playing ball and co-operate on the development of m-commerce in SA, which he sees as being in its fledgling phase in a three-tier process of "crawl, walk and run".

"We are at the crawl phase in SA, where 99% of mobile transfer services are voucher-based. I estimate that, with how SA works today, only about R20 billion in vouchers are generated and redeemed each year."

Going forward, says Singh, the "walk" phase will be when a wallet will enable and absorb the voucher system so that the voucher effectively becomes invisible.

"Over time, the voucher will be dematerialised into the wallet and I can see it being worth over R500 billion each year."

The third and final tier, he says, will probably take 10 years and will see the converged ability of cellphones coming to fruition - "true m-commerce".

"We will be able to use our phones on the high street to pay for physical goods, but also to access wallets and browse and make payments via the Internet. It will work everywhere."

He notes that the process is a marathon, rather than a sprint.

"When we launched Internet banking with Standard Bank around 1999/2000, it took six years for transactions to reach R1 trillion. I see the same happening with m-commerce. It could take six to 10 years to reach the run stage."

It's about the customer

Singh says, in theory, with telcos bringing a unique capability to the overall ecosystem and different players facilitating cross-platform value and access, the next five to 10 years will see partnerships becoming more open and less proprietary.

"It is not only about the technology, but about the customer, business model innovation and commercial partnerships and inter-operability.

"The final point is there is an infatuation with owning the customer. And no one asks the customer if he wants to be owned and no one can own the customer. It is about access to, rather than ownership of, the customer.

"We need to recognise this and stop proprietary - it is deprecated in these days and in a world where customers have freedom of choice. But some give customers free from choice instead."

As the industry upgrades, he says, this is where the thinking will lie. "It also means that a telco like Vodacom would partner with a number of people. Even if only one bank can sponsor a product, it doesn't mean all banks can't assist with enabling transactions by opening up their systems."

He says telcos, retailers and banks are only beginning to dance at the moment, but they are "soon to do the tango".

Share